DigitalX Limited provides the following report on activities completed in the quarter ended 31 March 2019.

HIGHLIGHTS

- Strategic investment and advisory engagement to launch the XGold Stablecoin

- Experienced director Mr Stephen Roberts appointed

- Additional funding for acceleration opportunities secured post quarter end

QUARTERLY OVERVIEW

A. Summary of Working Capital Position

DigitalX had cash, listed digital assets and fund units of ~US$5.77m in value at quarter end. The Company notes the post quarter end ASX announcement on 16 April 2019 regarding the $2m underwritten SPP and the significant increase in the price of Bitcoin post the quarter end.

DigitalX exchange listed digital asset holdings and units in the DigitalX Investment fund units as at 31 March 2019 are tabled below:

| Symbol | Name | Balance | Spot Price | Value (USD) @ Qtr end |

| USD | US Dollars | $3,434,999 | ||

| BTC | Bitcoin | 428 | $4,112 | $1,760,268 |

| – | Other listed altcoins | $90,273 | ||

| – | Unlisted units in fund | $487,493 | ||

| Total | $5,773,033 |

1 Total excludes amounts for tokens pending listing on an exchange and/or for which an active market is not observable. DigitalX has additional unlisted digital assets.

The Company offers advisory services for new token offerings, asset management focused on technology, including blockchain and cryptoassets, blockchain development and media services.

B. Business Activities

Token Advisory

DigitalX continued to provide Initial Coin Offering (ICO) advisory assistance during the quarter to clients including Bankorus, Bamboo and Human Protocol. DigitalX has been working on shaping its offering towards Security Token Offerings (STOs) as the market matures.

DigitalX continues to review the STO marketplace through its business as well as DX Americas in the United States. The Company believes it is well placed to add significant value to the market through its blockchain technical expertise, marketing team at Coincast Media and investment network.

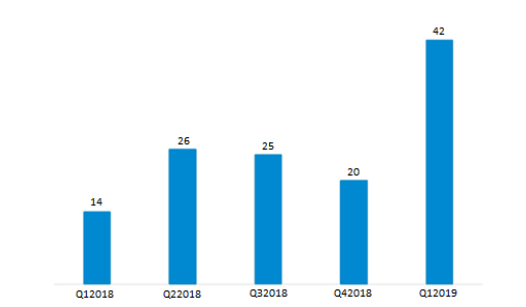

Table 1. Number of STOs (Per Quarter)

Source. https://www.inwara.com/security-token-offerings-three-things-to-know

Some of the major cryptoasset exchanges have started offering ICOs directly to their userbase in a process known as an Initial Exchange Offering (IEO). The major benefits for the cryptoasset is the existing exchange userbase, safe investment payment infrastructure, perceived endorsement from the exchange and near-term token listing. DigitalX is exploring the potential of IEOs for cryptoasset projects.

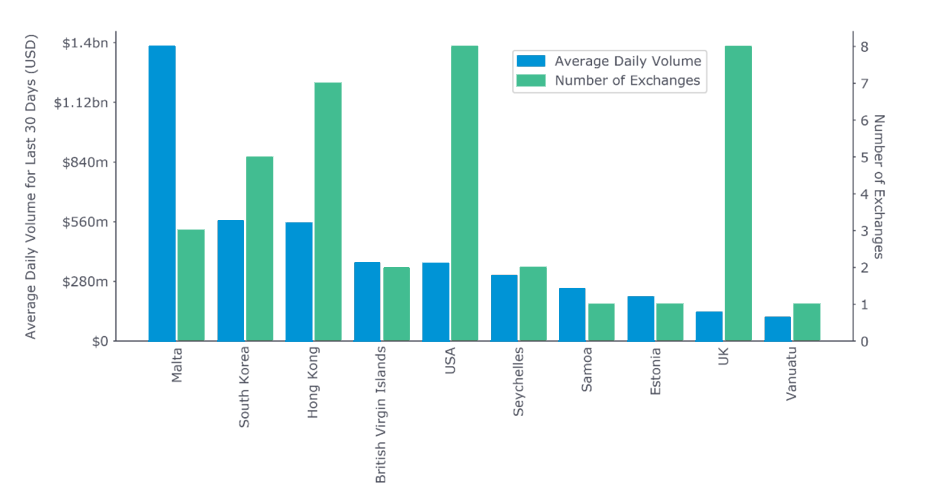

The highest cryptoasset exchange trading volumes are currently occurring in Malta and DigitalX has made reasonable progress on establishing a network of advisors and professional services in this country to enable the company to capitalise on this market. DigitalX is undertaking rigorous due diligence on applying for a Virtual Financial Asset license through the Malta Financial Services Authority (MFSA) to take advantage of opportunities in cryptoassets in the region.

Table 2. Global Exchange volume by region

Source 2. https://blog.bitmex.com/crypto-currency-exchange-review-from-cryptocompare/

Source 2. https://blog.bitmex.com/crypto-currency-exchange-review-from-cryptocompare/

Blockchain Consulting

DigitalX provided smart contracting services for Bullion Asset Management (BAM) based in Singapore to launch XGold, a stablecoin backed by vaulted, audited and insured gold. BAM is represented by gold bullion experts and tier 1 advisors and DigitalX is excited about bringing another blockchain product to market. The Company is looking to grow its business through offering boardroom workshops for executives on how to use blockchain in their business and will be leveraging the Perth Blockchain Centre to deliver services.

DigitalX Asset Management

The Asset Management division has been focused on developing new investment product strategies, and on continuing to develop partnerships and its distribution network in Europe and the Americas. The portfolio management team has been focused on developing new investment strategies driven by fundamental research and analysis, as well as focusing on equity and token investments. After completing the initial phases of strategy development, the distribution team began outreach for fundraising in Europe and Latin America during the quarter, and will continue this effort over the next months.

The division has also revamped marketing efforts around the cryptocurrency fund based in Australia in response to market interest and expects to expand these efforts going forward. After a year of operation, the fund outperformed the benchmark top 20 cryptocurrency index.

Media and Education “Coincast Media”

Coincast Media is continuing to grow its media publishing and investor relations business, despite a soft quarter for media services companies generally.

During the quarter, Coincast Media was engaged to provide media, marketing and PR services for energy tech company Power Ledger – which was last year named the winner of Sir Richard Branson’s international Extreme Tech Challenge.

The company will also provide media and marketing services for XGold in the coming quarter.

During the quarter, the company reached an agreement with international streaming service DIVAN.TV to rebroadcast Season One of Coincast TV.

Coincast TV is one of the first programmes to be offered through its new blockchain-based platform, which is introducing Real-Time Bidding (RTB). RTB is a system through which viewers watch ad-supported content for 30% of the revenue generated by the advertising and content owners receive 50% of the total advertising revenue.

Coincast Media is in discussions with a number of broadcasters, including OTT streaming services, for the next series of Coincast TV.

Coincast Media is a joint venture company with Multiplier Media.

Corporate Overview

Legal Proceedings

Further to the announcement on 28 September 2018 in relation to the court proceedings DigitalX have attended mediation in late March. The Company continues to work towards a resolution of the matter.

C. Post Quarter

Post the end of the quarter, on 16 April 2019, the Company announced a Share Purchase Plan (SPP) to raise A$2 million (before costs). The SPP will be underwritten to A$2 million by Patersons Securities Limited (Patersons) which is acting as Lead Manager and Underwriter to the offer. Eligible Shareholders will have the opportunity to purchase up to A$15,000 worth of fully paid ordinary shares in the Company at a 20% discount to the 5 day VWAP of the Company’s Shares trading on ASX over the last 5 trading days on which Shares were traded immediately before the issue date of the Shares, irrespective of the size of their shareholding, without incurring brokerage or transaction costs.

Additionally, the Company appointed Patersons to facilitate an offer of New Shares to be issued through a potential Top-Up Placement which, if conducted, will seek to raise up to a further A$2 million (before costs) from professional and sophisticated investors, following the close of the SPP, at the same price as the SPP.

On 16 April 2019, the Company also announced its engagement with and investment into Bullion Asset Management Services Pte Ltd (BAM), a company incorporated and operating in Singapore that is creating a gold backed cryptocurrency stablecoin called XGold, to acquire an approximately 17.5% interest in BAM. DigitalX will be provide blockchain technical services, blockchain auditing, media & PR, corporate advisory and exchange listing introductions to assist in the success of XGold.

D. Outlook

With a renewed market interest in cryptoassets, additional funding secured to facilitate the evaluation of potential investment and the establishment of DigitalX as a leader in the stablecoin market management and the Board of DigitalX believes the outlook for the Company is strengthening. Further, as the STO market matures over 2019, DigitalX is well positioned to provide services to the expected growth in the sector.

“DigitalX is strongly positioned to take advantage of the renewed optimism in cryptoassets and this is due to the focus of our team in maintaining momentum in recent months amid softer prices for digital currencies,” said DigitalX CEO Leigh Travers.

About DigitalX

DigitalX is a blockchain and cryptoasset finance company with offices in Perth, Sydney and New York. The company offers advisory services for new token offerings, asset management focused on technology, including blockchain and cryptoassets, blockchain development and media services. www.digitalx.com