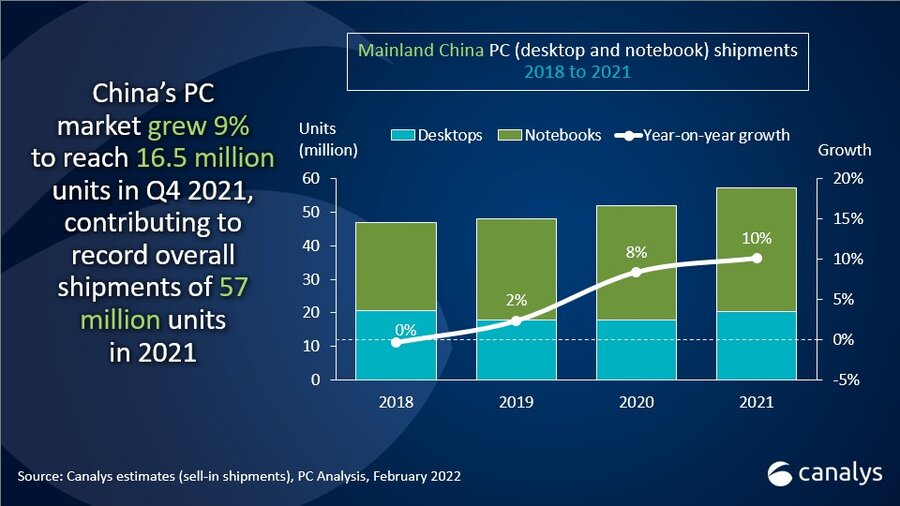

PC shipments (excluding tablets) in China grew 9% to reach 16.5 million units in Q4 2021. This finished another year of strong growth for the Chinese market, which saw shipments rise 10% in 2021 to a record 57 million units.

Notebook shipments grew 12% year on year to 10.8 million in Q4, and 8% to 36.5 million for full-year 2021. Desktops also grew in the final quarter, with shipments up 2.5% at 5.6 million units, leading to a full-year total of 20.4 million units, 15% higher than in 2020.

“China’s PC market is undergoing upheaval due to public sector interventions, but the strong growth seen in 2021 emphasizes how big an opportunity there still is,” said Emma Xu, Canalys Analyst.

“Security concerns about government procurement are growing, and there is a preference for local vendors, which puts additional competitive pressure on US-based vendors, such as HP and Dell. In the SMB space, businesses are in the middle of a recovery following the imposition of strict regulations on several sectors, such as housing, the education market and Internet companies, in 2021. Some of this government intervention has proven favorable to the IT industry as a whole, such as the increase in online content production for education and entertainment, and support for start-ups that are focused on delivering innovative technology to support government goals around economic transformation. Investment by larger enterprises is a key opportunity that will especially benefit PC vendors that can provide extensive and customized IT solutions in addition to top-notch hardware. Finally, in the consumer market, exciting innovations are coming from the upstream component side, notably in the battle between CPU vendors. Beyond Intel and AMD, Apple has announced further development of its M1 chipsets, while Qualcomm has also signaled an increased focus on PCs, with both companies targeting the premium market. Improvements in display size and functionality as well as form factor innovations, such as foldable PCs, have been major themes at CES and MWC this year, and China’s role as a keen adopter of new technology will see vendors focus their efforts there.”

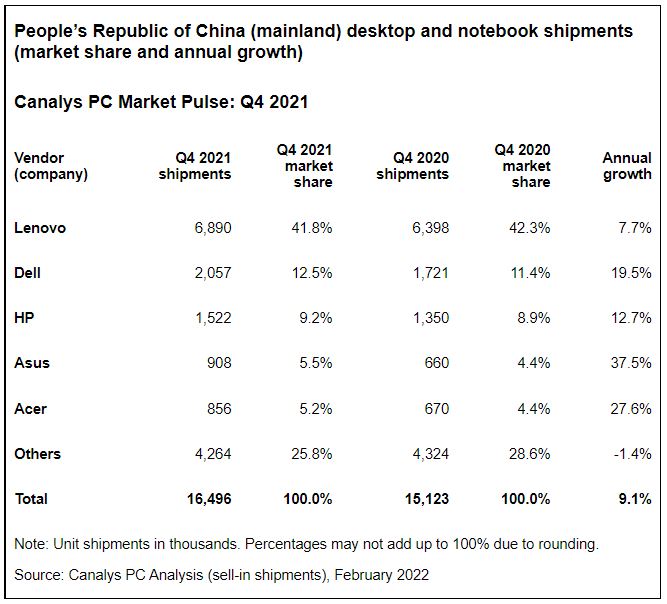

In desktops and notebooks, Lenovo topped the market with 6.9 million units shipped in Q4, up 8% year on year, as it used its strong traction with commercial customers.

Dell cemented its position in second place, gaining 1% market share from a year ago as its Q4 shipments reached 2.1 million units, up 20% year on year.

HP stayed in third with 1.5 million units shipped, growth of 13% from Q4 2020.

Asus regained fourth place with 38% growth, shipping 0.9 million units in Q4 2021, on the back of the success of its ROG gaming brand and the VivoBook and ZenBook series.

Fifth-placed Acer was just slightly behind Asus and posted impressive growth of 28% year on year.

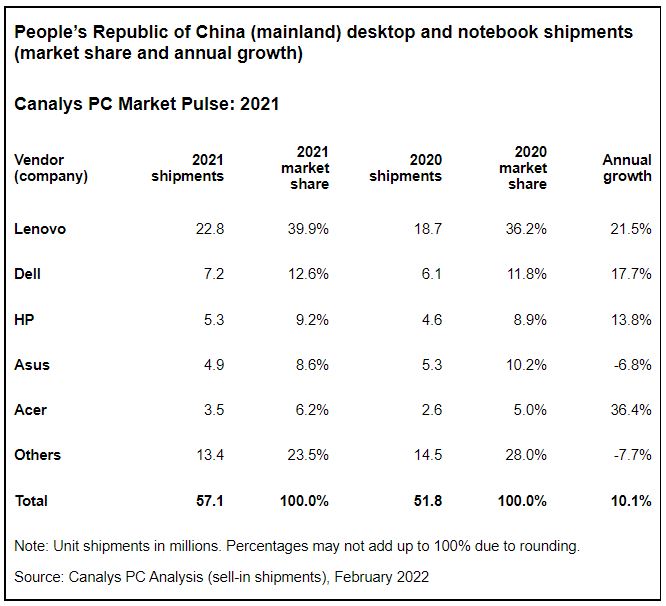

On a full-year basis, the market was more concentrated among the top vendors in 2021.

Lenovo grew its market share from 36% in 2020 to 40% in 2021, extending its lead in its home market.

Second-placed Dell saw its market share rise 1% from 2020 on the back of 18% shipment growth.

HP ended the year as the third-largest vendor in China, with 14% growth over 2020 for total shipments of 5.3 million units in 2021.

Asus and Acer finished fourth and fifth respectively, with the former achieving the highest annual growth of the top vendors at 36%.

“In 2021, exemplary supply chain management strongly benefited the largest vendors, while proving to be a huge challenge for smaller players and new entrants,” said Xu. “The growth in online PC purchasing in China also required vendors to make significant investments in online marketing campaigns, distribution and after-sales service to manage their reputations and businesses. This intense competition is set to reach another level in the Chinese PC market with new COVID-19 lockdown restrictions being implemented in several cities as of March 2022. With millions of people facing disruption to work, education and leisure yet again, there is a big opportunity for PC vendors with strong product portfolios, adequate device supply and go-to-market mastery to enjoy further growth.”