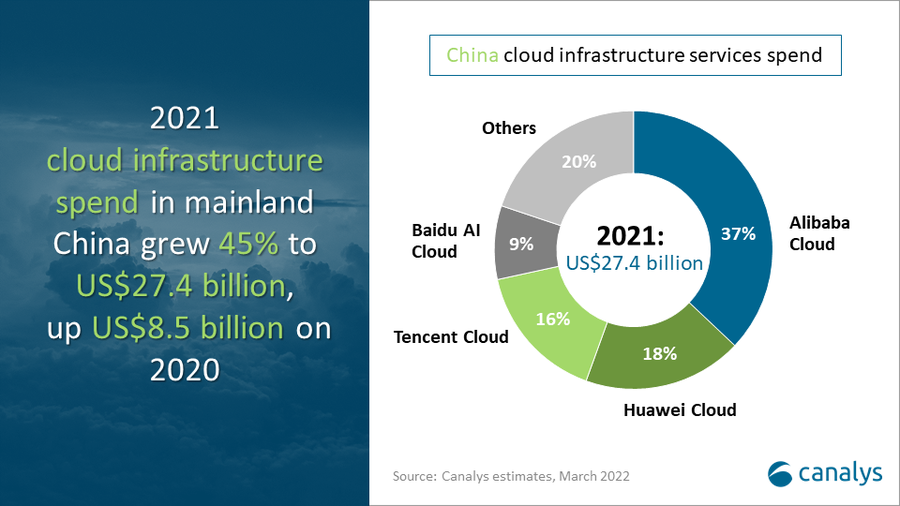

Overall, 2021 was a strong year in mainland China, with the cloud infrastructure services market growing 45% to a total of US$27.4 billion. The year was closed out by a healthy 33% year-on-year growth in Q4 2021, which reached US$7.7 billion.

Lasting pandemic-related consumption drivers, such as remote working and learning, ecommerce and content streaming remained important contributors. In addition, the boom in digital transformation strategy execution by traditional enterprises has increased the demand for services.

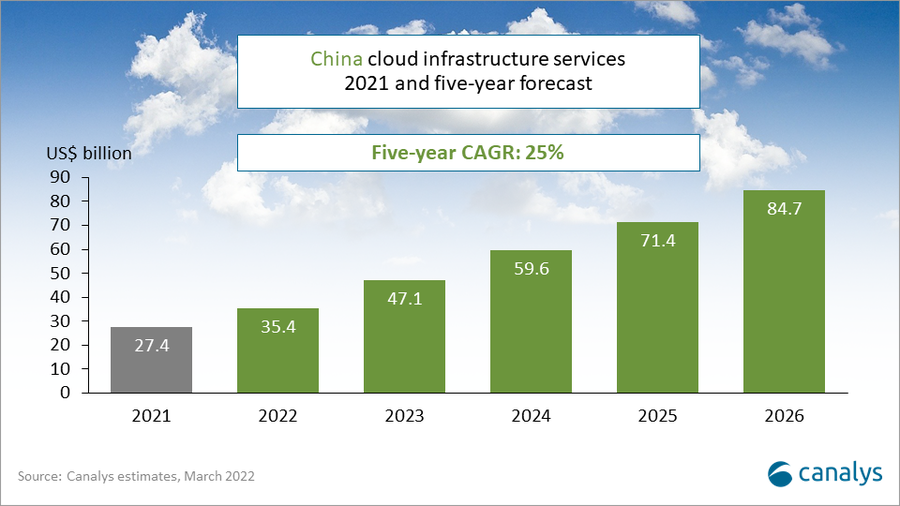

Canalys expects the cloud infrastructure market in mainland China to reach US$85 billion by 2026, representing a five-year CAGR of 25%.

Alibaba Cloud maintained its lead and was the number one player in the cloud market for 2021, with Huawei Cloud and Tencent Cloud in second and third place respectively.

Baidu AI Cloud occupies the fourth position. Together the top four cloud vendors accounted for 80% of the market in 2021, and all four are launching strategies to capture growth opportunities across industry vertical solutions.

The market is witnessing a diversification trend in its client base, ranging from the Internet industry to traditional industries such as manufacturing, finance and retail.

Increasing business resiliency is a key fuel for digital transformation efforts and will continually drive cloud services spending through operational workload migration and cloud-native application development.

“Enterprise investment in digital transformation is continuing at pace and has created a massive opportunity for cloud service providers,” said Canalys Research Analyst Blake Murray. “But these efforts are multi-year, highly complex projects, which require cloud vendors to provide technical capabilities and professional experience across multiple vertical areas to satisfy customized requirements. Developing trust with channel partners is more important than ever to meet these requirements, build trust with customers, and ultimately drive competitive positioning.”

“Although government policy support for digital transformation has brought about an uptick in cloud adoption in traditional industries, customers still have a limited ability to manage and develop cloud technologies,” said Canalys Research Analyst Yi Zhang. “In addition to technical performance and data security, cloud vendors need to focus more on how to reduce the learning time and management costs of enterprises.

Tapping into new business value for traditional enterprises through cloud services is also critical to the future of the industry.”

Alibaba Cloud led the cloud infrastructure services market in 2021, accounting for 37% of total spend.

Alibaba’s slight decrease in market share in 2021 is mainly attributed to policy regulation which impacted it by slowing the growth of Internet-based customers.

However, it still grew 30%, driven by long-term consumption commitments from key clients and expansion of its business in traditional industries. Alibaba Cloud also recently launched the strategy ‘DingTalk with Cloud’.

DingTalk, a communication and collaboration platform for enterprises, will serve as an entry point for cloud services into traditional industry sectors. A low-code development platform based on DingTalk is designed to help these companies in their digital transformation strategies, reducing barriers and complexity.

Huawei Cloud reached an 18% market share in 2021, growing 67% annually. The rapid growth has widened the gap between Huawei Cloud and Tencent Cloud and secured the second position in the market. With specialty industry experience in government affairs, Huawei Cloud has consistently maintained a leadership position in this segment.

As the only ‘non-Internet’ company among the top three vendors, Huawei is also continuously expanding the customer base of Internet companies. Its ‘cloud-to-cloud collaboration’ strategy aims to position Huawei as a key partner for clients across China’s Internet sector. This strategy has won key customers for Huawei Cloud, compensating for its shortcoming of lack of Internet ‘genes’ that its direct competitors can claim.

Tencent Cloud, the third largest provider, accounted for 16% of the market, growing 55%. Tencent Cloud’s overall growth in 2021 was steady, with diversified growth across multiple sectors. As a pan-entertainment industry-focused Internet company, Tencent Cloud has also started to expand its customers to include more traditional sectors.

For example, it has won key users in the government sector through its strength in big data solutions. The potential of metaverse interests will bring new business opportunities to Tencent in the future due to its experience in gaming, social media and digital commerce.

The fourth provider, Baidu AI Cloud, accounted for 9% of the market, also growing 55%. Due to its business mainly focused on online marketing and AI, Baidu was impacted less than Tencent and Alibaba by government regulations over the last year. Baidu AI Cloud combines AI technology with cloud infrastructure services and focuses on intelligent services to highlight its differentiation.

Compared to the other three cloud vendors, Baidu AI Cloud has chosen the industrial segment as its main target opportunity, with key wins in industrial internet, smart manufacturing, energy, and power utilities.

Canalys defines cloud infrastructure services as services that provide infrastructure as-a-service and platform as-a-service, either on dedicated hosted private infrastructure or shared public infrastructure. This excludes software as-a-service expenditure directly, but includes revenue generated from the infrastructure services being consumed to host and operate them.