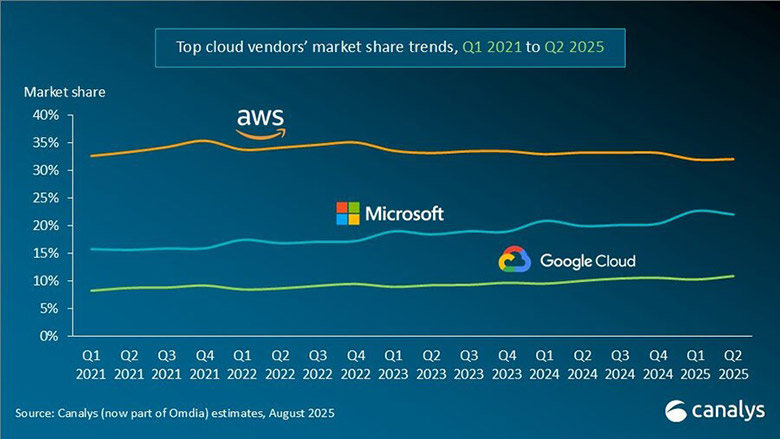

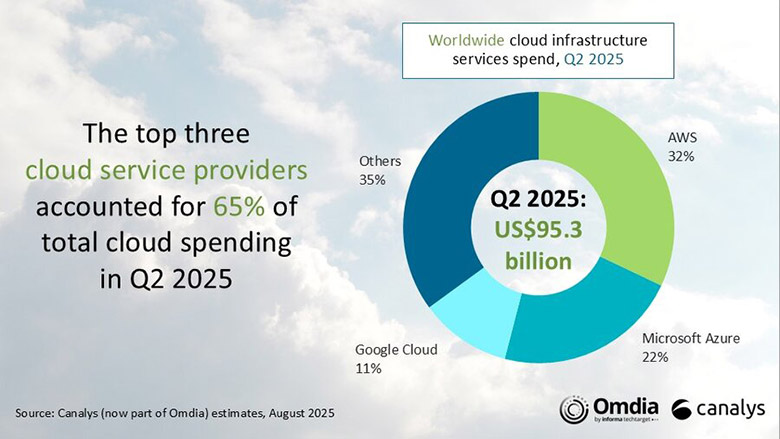

According to Canalys (part of Omdia), global spending on cloud infrastructure services reached US$95.3 billion in Q2 2025, up 22% year on year. Market momentum remained stable, with year-on-year growth exceeding 20% for the fourth consecutive quarter. Cloud demand increased due to AI consumption, revived legacy migrations and cloud-native scale-ups. As hyperscalers advance their AI capabilities and applications, more customers are adopting multi-model approaches to meet specific cost and use-case requirements. In Q2 2025, AWS, Microsoft Azure and Google Cloud retained their rankings from the previous quarter, with their combined market share accounting for 65% of global cloud infrastructure spending. Collectively, customer spending with these three hyperscalers increased 27% year on year.

Microsoft Azure and Google Cloud delivered gains significantly exceeding 30% in Q2 2025, while market leader AWS posted year-on-year growth of 17%, consistent with the previous quarter. In actual dollar terms, however, AWS’s year-on-year increase outpaced that of both Microsoft and Google Cloud.

Hyperscalers are experiencing a significant increase in customer demand, with growth driven by AI-related workloads alongside a rebound in traditional migrations and continued capacity expansion by cloud-native enterprises. Investment in AI infrastructure continues to accelerate. In July, Google lifted its 2025 capital expenditure target from US$75 billion to US$85 billion; earlier, AWS projected total spending for 2025 to exceed US$100 billion, while Microsoft announced plans to invest approximately US$80 billion in infrastructure expansion in the current fiscal year.

“Customer demand for AI services is evolving from a primary focus on availability and ease of use to a greater emphasis on flexibility and fit-for-purpose model choice,” said Yi Zhang, Senior Analyst at Canalys (part of Omdia). “An increasing number of enterprises are seeking the capability to switch between different AI models based on specific business requirements, enabling them to achieve an optimal balance of performance, cost and application fit.” Amid this trend, AWS Bedrock, Azure AI Foundry and Google Vertex AI continue to broaden their portfolios of proprietary and third-party models, spanning the full spectrum of capabilities from high-complexity reasoning to low-latency response, thereby supporting a wider range of industries and workloads.

“‘Coopetition’ has become the norm in the generative AI landscape: vendors compete on model advancement and product capabilities even as they collaborate on compute capacity and model distribution,” said Rachel Brindley, Senior Director at Canalys (part of Omdia). “For example, AWS Bedrock aggregates models such as Anthropic’s Claude and OpenAI’s GPT, while OpenAI has added Google Cloud to its compute network to bolster capacity. By sharing resources and leveraging complementary strengths, vendors aim to accommodate accelerating demand.”

Michael Azoff, Chief Analyst at Omdia, said, “There is a need for open-source AI that drives downstream innovation and is welcomed by the open-source community. There is a trend in the market for opening up weights in models: Meta, DeepSeek and now OpenAI.”

Amazon Web Services (AWS) led the global market in Q2 2025 with a 32% share and 17% year-on-year revenue growth. Its growth has remained largely steady since Q1 2024, ranging from 17% to 19% year on year over the past six quarters. It reported a total backlog of US$195 billion as of 30 June, up 25% year on year, underscoring sustained demand. But shortages of power and semiconductor resources have limited computing capacity expansion, constraining overall growth. To accelerate the production and scaling of AI applications, in July, AWS launched Amazon Bedrock AgentCore and a new “AI Agents & Tools” category on AWS Marketplace, featuring over 800 agents and tools, to streamline AI agent deployment and commercialization. In August, it integrated Anthropic’s Claude Opus 4.1 and OpenAI’s GPT-oss models into Amazon Bedrock, broadening enterprise access to advanced AI capabilities. AWS also announced multi-billion-dollar investments to expand cloud infrastructure and advance AI innovation in North Carolina, Pennsylvania and Australia.

Microsoft Azure remained the world’s second-largest cloud provider in Q2 2025, with a 22% market share and impressive 39% year-on-year growth. This growth was driven by three factors: the migration of traditional workloads to Azure, the continued scaling of application deployments by cloud-native enterprises and the rapid adoption of AI workflows. Azure AI Foundry has continued to expand its model portfolio, adding offerings from OpenAI, DeepSeek, Meta and xAI’s Grok, with forthcoming models from Black Forest Labs and Mistral AI. In May, Microsoft announced the general availability of Azure AI Foundry Agent services, now used by over 14,000 customers to build agents that automate complex tasks. In August, it fully rolled out OpenAI’s new flagship model, GPT-5, on Azure AI Foundry, accessible via API and orchestrated through its model router. Microsoft also expanded its global infrastructure footprint, opening new data centers on six continents and bringing its total to more than 400 in over 70 regions.

Google Cloud, the world’s third-largest cloud service provider, recorded robust year-on-year growth of 34% in Q2 2025, increasing its market share to 11%. Growth was supported by strong deal momentum – its number of contracts valued above US$250 million reportedly doubled year on year, while US$1 billion agreements signed in the first half of 2025 matched the total for all of 2024. Its order backlog stood at US$108.2 billion as of 30 June, up from US$92.4 billion in Q1. To address strong demand and alleviate supply constraints, Google announced an increase in its 2025 capital expenditure, raising the planned total from US$75 billion to US$85 billion. In June, it announced the general availability of Gemini 2.5 Flash and Pro, alongside the launch of 2.5 Flash-Lite, which it claims to be the most cost-efficient and fastest 2.5 model to date. Gemini now serves over 450 million monthly active users, with daily requests rising by more than 50% quarter on quarter. In July, reports emerged that Google Cloud may join OpenAI’s cloud supply network to provide additional compute capacity for its growing training and inference workloads.

Canalys (part of Omdia) defines cloud infrastructure services as the sum of bare-metal-as-a-service (BMaaS), infrastructure-as-a-service (IaaS), platform-as-a-service (PaaS) and container-as-a-service (CaaS) and serverless options that are hosted by third-party providers and made available to users via the Internet.