Global PC shipments rebounded strongly in 2025, but tightening memory and storage supply is already creating pricing pressure that could weigh on market momentum in 2026, according to new research from Omdia.

The analyst firm said global shipments of desktops, notebooks and workstations grew 10.1% year-on-year in the December quarter to 75 million units, lifting full-year 2025 volumes by 9.2% to 279.5 million units. Notebook shipments accounted for the bulk of the market, reaching 220.4 million units for the year, while desktop shipments rose 14.4% to 59 million units.

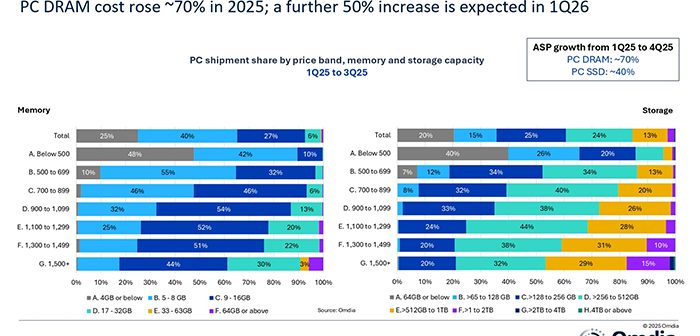

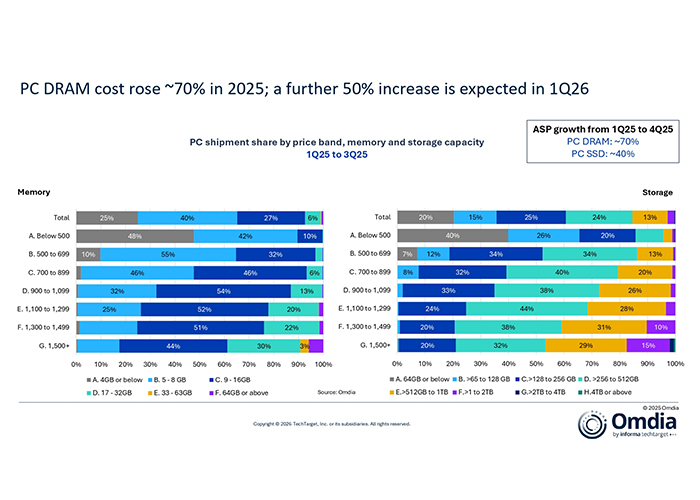

Despite the healthy growth, Omdia warned that constraints in memory and storage supply began to emerge mid-year, driving sharp increases in component costs. Between the March and December quarters of 2025, mainstream PC memory and storage costs rose between 40% and 70%, with vendors increasingly signalling price rises toward the end of the year.

Omdia principal analyst Ben Yeh said these supply-side pressures are already dampening shipment expectations for 2026, even as device refresh cycles remain active. Vendors are responding by prioritising higher-end configurations and trimming mid- and low-tier specifications in an effort to protect margins amid constrained supply.

Market leadership in 2025 remained concentrated among the top vendors. Lenovo led the global market with shipments of 71 million units, capturing a 25.4% share. HP followed with 57.4 million units and a 20.6% share, while Dell ranked third with 41.9 million units, representing 15% of the market. Apple and Asus rounded out the top five, with Apple standing out as the fastest-growing vendor, recording 16.4% annual growth.

Looking ahead, Yeh said actual shipment performance in 2026 will depend less on demand and more on vendors’ ability to secure component supply. Procurement leverage, supplier relationships and execution discipline will be critical differentiators, particularly as supply is unlikely to fully meet demand.

An Omdia survey of B2B channel partners conducted in November 2025 suggests demand conditions remain favourable, with 57% of respondents expecting PC business growth in 2026 compared with 2025. Omdia said this creates an opportunity for vendors best positioned to manage supply constraints, while CIOs and IT buyers should expect continued price volatility and tighter availability across mainstream configurations.