Canalys’ Steve Brazier says the global technology sector is entering a period of rapid change driven by unprecedented investment in artificial intelligence and a looming shortage of key components, warning businesses to prepare for significant supply constraints through 2026.

Speaking at the opening plenary of Canalys APAC Forum in Da Nang, Vietnam this morning, Brazier said the technology sector continues to outperform global economic and political volatility, noting that countries with strong tech ecosystems, such as Taiwan, South Korea and Vietnam are experiencing the fastest growth. In contrast, economies tied to legacy industries risk falling behind.

Brazier said artificial intelligence is the defining force reshaping the industry, describing it as the fastest-adopted technology in history. “Around two billion people use AI tools every month,” he said, adding that more than 25 per cent of the world’s population has adopted generative AI tools in the three years since ChatGPT’s launch. Consumers, he noted, are already demonstrating willingness to pay for premium AI services.

Competition among AI model developers is intensifying. Google’s Gemini is now outperforming ChatGPT in several benchmarks, while Anthropic has become a leading platform for software developers. This competition, Brazier said, has triggered an unprecedented wave of capital expenditure.

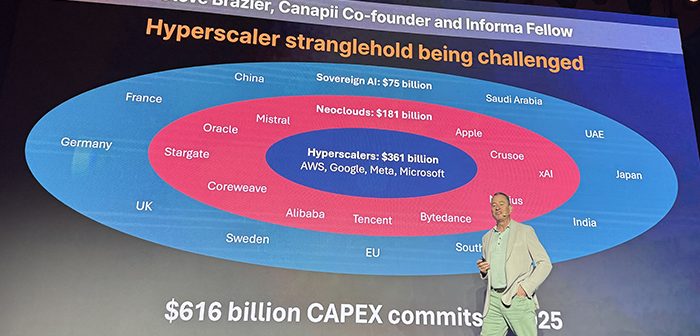

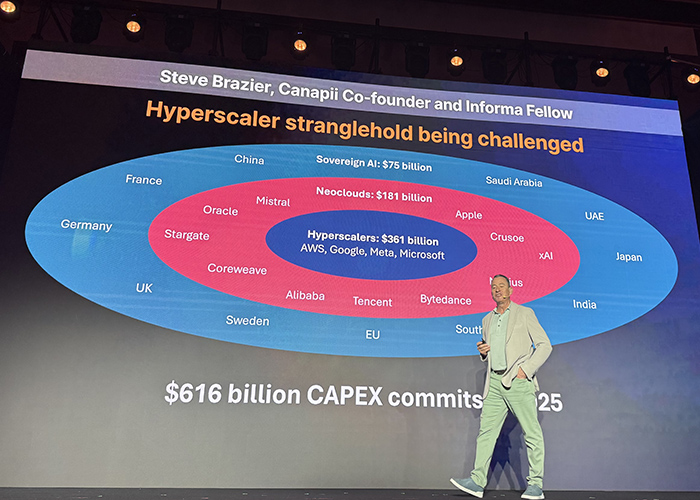

Hyperscale cloud providers, including Amazon, Google, Meta and Microsoft are on track to invest US$360 billion this year alone. Additional spending from emergent “neo-cloud” providers such as Crusoe, CoreWeave, Mistral and others add another US$180 billion. Governments worldwide are also accelerating AI investment, particularly for military and cybersecurity applications, contributing an additional US$75 billion in 2025.

According to Brazier, this level of spending gives leading tech companies influence that in many cases surpasses national governments. While public budgets struggle with debt and rising costs, hyperscalers now consider US$20 billion to be relatively modest capital spend.

Competition within the semiconductor industry is also shifting. Hyperscalers are developing their own silicon to reduce dependence on Nvidia, while also backing AMD and other emerging players to drive pricing competition. Meanwhile, Nvidia and other chipmakers are strengthening ties with neo-cloud providers to diversify their customer base.

However, Brazier said the surge in data-centre investment has created an unexpected outcome: a global shortage of DRAM and storage. “The world is out of memory,” he said, noting that hyperscalers have effectively purchased the available supply for the next year. DRAM manufacturers operate on a first-come, first-served model, and the largest buyers are now absorbing all available production.

Brazier warned that no meaningful memory supply is expected to return to the market until late 2026. As a result, PC and device makers may reduce minimum RAM configurations, discontinue lower-end models and shift production toward more profitable high-end systems. He said forecasts of PC market growth in 2026 are unlikely to materialise due to supply constraints rather than weakening demand.

For channel partners and IT providers, Brazier urged immediate action. “If customers are not buying in December, you cannot promise to supply them in Q1,” he said. He warned that organisations with device fulfilment contracts must reassess their obligations, as shortages could lead to failures similar to those experienced during the pandemic.

Brazier said companies holding inventory through early 2026 are likely to benefit, as constrained supply is expected to raise the value of existing stock. While not offering investment advice, he described the coming year as a period where “anyone with inventory wins.”

The address underscores a central message: the AI boom is accelerating faster than any previous technological shift, but the infrastructure behind it is straining. Businesses, Brazier said, must understand both the opportunities and the risks if they want to navigate the next phase of the industry’s transformation.

Image: Steve Brazier delivering his opening keynote at Canalys APAC Forum 2025. Credit: MySecurity Media – attending courtesy of Omedia.