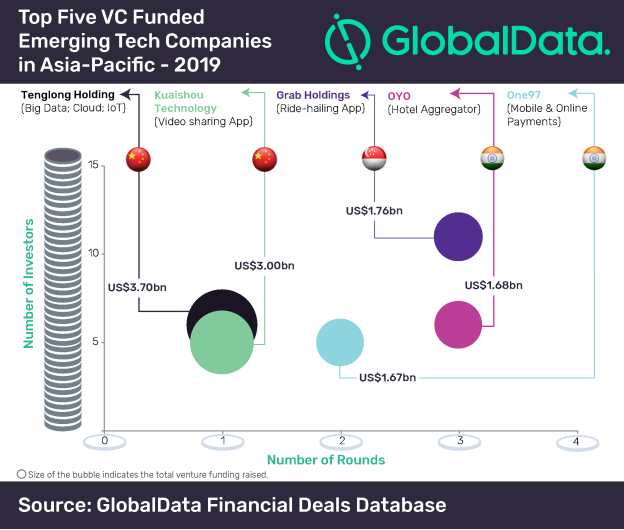

Chinese firms occupied the top two positions in the list of top five venture capital (VC) funded emerging tech companies in the Asia-Pacific (APAC) in 2019, according to GlobalData.

The remaining positions were occupied by one Singaporean firm and two Indian firms.

Tenglong Holding Co Ltd (Tenglong Holding) raised US$3.7bn, the highest VC funding among all companies during 2019. The company is active in data centers space and offers Big Data, cloud and Internet of things (IoT) related solutions. It was closely followed by Beijing Kuaishou Technology Ltd (Kuaishou Technology), which operates a video sharing app.

These two Chinese companies collectively raised US$6.7bn and were also ahead of other three companies in terms of total funding raised during 2019. The remaining three companies in the list raised a total VC funding of US$5.1bn.

Aurojyoti Bose, Lead Analyst at GlobalData, comments: “Tech innovation has grown significantly in China. Moreover, China has already created conducive environment for companies such as Tencent, Alibaba and Baidu to emerge as tech giants, which also encourages VC investors to place bets in start-ups in the country. In addition, most of current VC backed start-ups in China are also scaling up very fast.”

For instance, Tenglong Holding, founded in 2015, is now one of top Internet Data Center (IDC) service providers in China while Kuaishou Technology, founded in 2011, has become a dominant name in video sharing app space and is considered a major rival of Bytedance, which owns short video app, TikTok and live streaming app, Douyin.

Bose adds: “In addition to China, tech start-ups in other APAC countries such as Singapore and India are also on VC investors’ radar.”

Singaporean firm Grab Holdings (Grab) and Indian firms, Oravel Stays Private Limited (OYO) and One97 Communications Ltd. (One97) occupied the third, fourth and fifth position, respectively.

While Grab is a provider of ride-hailing transport services, OYO is an online hotel and One97 is a fintech firm providing payment solutions.

Bose concludes: “The APAC countries hold tremendous potential for tech innovation. However, it remains to be seen if the coronavirus outbreak in China and its subsequent spread in other nations will dent VC funding support for start-ups in the region. Nevertheless, announcement of some of the big ticket deals (such as US$1.2bn raised by Indonesia-based Go-Jek in March 2020) in recent times depict investors’ confidence amidst concerns.”

In addition to China, tech start-ups in other APAC countries such as Singapore and India are also on VC investors’ radar.”