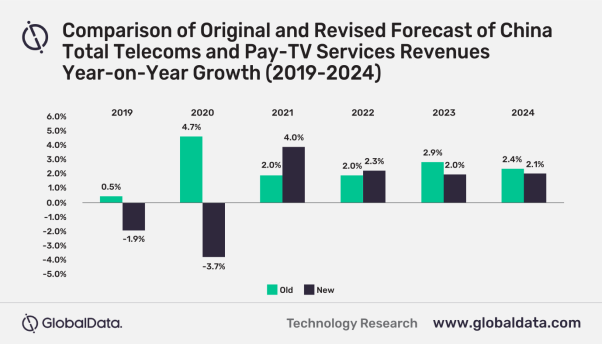

The revenues for the total Chinese telecom and pay-TV services in 2020 will reach US$220bn, which is a drop of 9%. Due to COVID-19 impact, the overall Chinese telecom and pay-TV service revenues will decline by 3.7% Year-on-Year in 2020, according to the forecasts by GlobalData.

However, once the economy starts to recover, GlobalData expects the revenues to increase at a compound annual growth rate (CAGR) of 2.1% over 2021-2024, mainly driven by growth in mobile data, fixed voice and fixed broadband segments.

Despite negative adjustments due to COVID-19, mobile data will remain the largest revenue contributor between 2019-2024. Revenues will increase supported by growing mobile Internet subscriptions and increasing data ARPU over the forecast period. GlobalData amended its original forecast for mobile data in 2020 down 13.5% to account for the impact of the pandemic. The revised forecast expects mobile data to increase 1% Year-on-Year in 2020 and to increase at a CAGR of 7.5% 2021-2024.

Mobile subscriptions in China reached 1.6 billion by year-end 2019, accounting for 35.6% share of the total Asia-Pacific (APAC) mobile subscriptions for the year. GlobalData adjusted its original mobile subscriptions forecast for 2020 down 7%. Taking COVID-19 into account, GlobalData expects mobile subscriptions to decline 4% Year-on-Year in 2020. Mobile operators reported subscriber losses in Q1 2020 due to COVID-19, which forced retail stores to shut and spurred consumers to cancel secondary phone numbers.

Samuel Tan, Analyst at GlobalData, comments: “The adoption of 5G is a bright spark in the midst of the pandemic dampening down economic activity and keeping stores shut. Investments in 5G have been a part of a push for increased infrastructure spending under the Chinese government’s stimulus measures.”

China Mobile and China Telecom, the two largest telecommunications companies in China, accumulated 2.55 million and 4.61 million 5G users, respectively at the end of 2019, with targets to add a further 70 million and 60-80 million to their respective subscriber bases by the end of 2020.

While GlobalData forecasts strong 5G penetration across the forecast period, the estimate for 2020 remains more conservative due to the projected economic fallout from the pandemic and disrupted production of 5G smartphones and other electronics crucial to deploy 5G networks. GlobalData estimates 164 million 5G subscriptions by the end of 2020, which represents an 11% share of mobile subscriptions.

4,000 of the world’s largest companies, including over 70% of FTSE 100 and 60% of Fortune 100 companies, make more timely and better business decisions thanks to GlobalData’s unique data, expert analysis and innovative solutions, all in one platform. GlobalData’s mission is to help our clients decode the future to be more successful and innovative across a range of industries, including the healthcare, consumer, retail, financial, technology and professional services sectors.