Evolving business models with investments in VR & AR makes China unique amongst a global IT market

By Chris Cubbage, Executive Editor

Digitalisation in China has been rapid, on a massive scale and is unique beyond any other country on the planet. Ecommerce in China is now 18 per cent larger than that in the USA. With over 1.3 billion people, China is naturally a major market for IT and has evolved its own digital ecosystem, mirroring that of the West’s Google, Amazon and Facebook with the likes of Baidu, Alibaba and Tencent. Mobile apps have also played a major part, like WebChat, which has over 200 million users and AliPay with well over 300 million users, more users than the USA population.

Digitalisation in China has been rapid, on a massive scale and is unique beyond any other country on the planet. Ecommerce in China is now 18 per cent larger than that in the USA. With over 1.3 billion people, China is naturally a major market for IT and has evolved its own digital ecosystem, mirroring that of the West’s Google, Amazon and Facebook with the likes of Baidu, Alibaba and Tencent. Mobile apps have also played a major part, like WebChat, which has over 200 million users and AliPay with well over 300 million users, more users than the USA population.

The Chinese Government remains protective against foreign companies entering the market, despite the national economy slowing and transitioning from manufacturing to services. Verticals such as logistics, transport, retail, entertainment, healthcare and banking are all embracing digitalisation and the country is entering a golden era for integrating new technologies, with steady growth expected over the next decade.

The major drivers, according to Canalys APAC Research Director Nicole Peng, speaking last week in Macau at the Canalys APAC Channels Forum, has been driven by trends in the macro economy, consumer behaviour and online-offline market. Major trends in the macro economy has been the shift from manufacturing to services sector and strong encouragement from China’s Government for the country to innovate. The services sector now exceeds manufacturing as a GDP contributor and the country has also experienced rapid wage rises. The increases in wages has increased labour costs which is further driving business to focus on productivity. Urbanisation has led to better infrastructure, including network and wi-fi infrastructure. Increasing incomes has been significant for migrant workers moving within tier 2 and tier 3 cities and the logistics industry is a leading example of innovation within national supply chains.

The major drivers, according to Canalys APAC Research Director Nicole Peng, speaking last week in Macau at the Canalys APAC Channels Forum, has been driven by trends in the macro economy, consumer behaviour and online-offline market. Major trends in the macro economy has been the shift from manufacturing to services sector and strong encouragement from China’s Government for the country to innovate. The services sector now exceeds manufacturing as a GDP contributor and the country has also experienced rapid wage rises. The increases in wages has increased labour costs which is further driving business to focus on productivity. Urbanisation has led to better infrastructure, including network and wi-fi infrastructure. Increasing incomes has been significant for migrant workers moving within tier 2 and tier 3 cities and the logistics industry is a leading example of innovation within national supply chains.

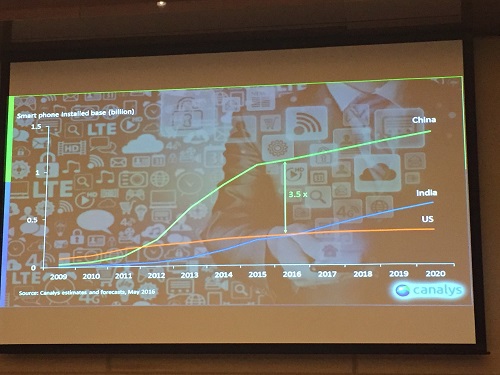

Another major trend is the consumer sector. China has a billion smart phone users and will grow to 1.3 billion by 2020. Online payment platforms such as Alipay are allowing rapid adoption of online and retail services, including the transition to accessing all of government services. Consumer expectations on business is for them to embrace new technologies.

The third major trend is the online to offline model which sets out to uncover latent supply between the physical and cyber experiences. This market is addressing an unmet demand in areas such as food ordering, travel, payments and transport on demand. There remains a large potential for greater cross selling and upselling to consumers in this area, with potential to best apply this market is the VR (Virtual Reality) and AR (Augmented Reality) technologies.

The third major trend is the online to offline model which sets out to uncover latent supply between the physical and cyber experiences. This market is addressing an unmet demand in areas such as food ordering, travel, payments and transport on demand. There remains a large potential for greater cross selling and upselling to consumers in this area, with potential to best apply this market is the VR (Virtual Reality) and AR (Augmented Reality) technologies.

VR and AR is anticipated to drive new digital transformation and provides a substantial user experience if correctly supported by new hardware and software. There remains a lot of challenges with the mix needing to combine the right form of hardware, new software platforms and most importantly, new content. Getting this mix right has the potential to fundamentally change how users operate online, engage socially and behave commercially.

The VR and AR market has the potential to kick start a new wave of business and next generation content. Canalys Analyst Jason Low predicts that the VR industry will ship 6.3 million headsets worldwide in 2016 with 40% of these for the China market. In VR, advertising offers a more engaging experience to the consumer and also offers wider options for product placement. With these benefits in mind, Badui is looking to transition customers from web browsers to new VR platforms. VR will therefore require new hardware, new software and most importantly, new content which will need to be based on combining user data, image recognition and generating customised content.

Alibaba is investing heavily in creating new online shopping experiences in new VR environments and virtual shopping malls will only be limited to the imagination of the developers. The aim is to change the way people shop for products online. The concept is to provide customers the ability to experience products virtually and generating immediate market scale by keeping the technology simple and accessible to everyone. With the amount of investment being made by the likes of Alibaba the VR technology is anticipated to mature quickly.

Alibaba is investing heavily in creating new online shopping experiences in new VR environments and virtual shopping malls will only be limited to the imagination of the developers. The aim is to change the way people shop for products online. The concept is to provide customers the ability to experience products virtually and generating immediate market scale by keeping the technology simple and accessible to everyone. With the amount of investment being made by the likes of Alibaba the VR technology is anticipated to mature quickly.

Tencent has diversified into mobile and online gaming and is the most relevant for deploying VR hardware whilst combining social networks and VR content. Tencent has released its new VR platform called SOLAR-VR and is seeking to significantly expand across its gaming platforms, accommodating casual gamers through to hardcore gamers.

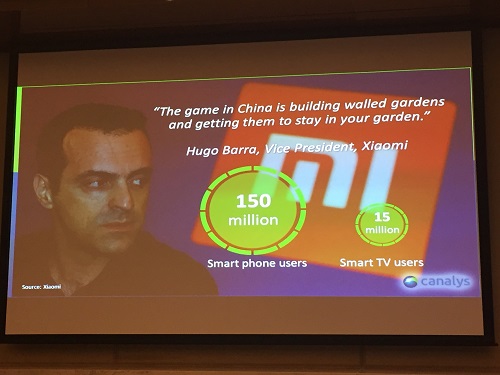

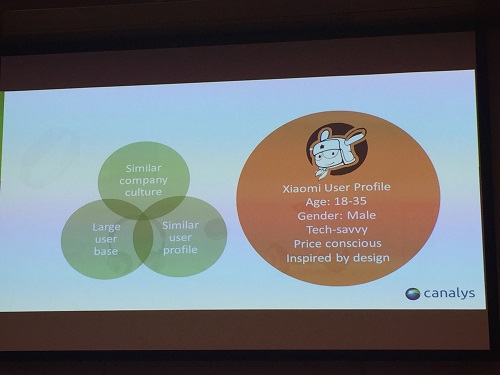

LeEco, China’s largest online video company and Xiaomi, the world’s fourth largest smart phone maker, comparatively operate as a mix of Apple, Amazon and Google with business models combining smart electronic hardware, online retail platforms and delivery of mobile services. Xiaomi has made investments into 50 companies that are producing new breeds of IT hardware ecosystems and has plans to expand its investments to reach 100 companies. Xiaomi investments follow strict rules that apply technology specifically to their user profile, namely 18 – 35 year old males that are tech-savvy, price conscious and inspired by design. The companies also need to have a similar culture to its own and need to have developed a large user base. According to Hugo Barra, Xiaomi’s Vice President, “the game in China is building walled gardens and getting them to stay in your garden.” Xiaomi is also amassing substantial data on its users to better understand and predict their behaviours. With 150 million users, they are each lighting their screens on average 122 times a day and have an average total daily screen time of 4.4 hours per user. In Tier 1 cities, 17 out of 100 people have a Xiaomi device and in Tier 2 and Tier 3 cities its 13 and 6 out of 100, respectively. Data is being collected on users accessing social media, video, tools, games, books and news. The data analytics business concept is to deliver services with precision marketing and generate consumer buying power.

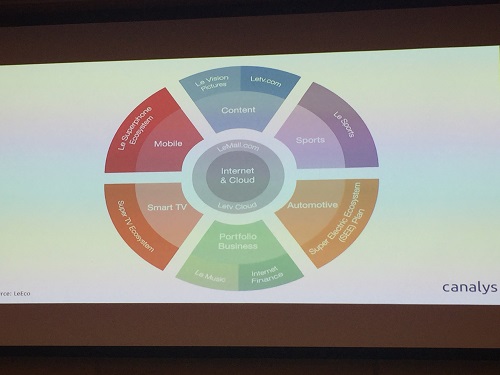

LeEco, similar to Netflix with on-demand video streaming has also entered the smart phone and smart TV sector and has founded its own digital ecosystem based on Internet and Cloud platforms, with LeMail.com and LeTV Cloud that is surrounded by content, mobile services, Smart TV hardware, Music, Internet Finance, Sports and Automotive, part of a Super Electric EcoSystem (SEE) Plan. These all-encompassing business plans are endeavouring to brings multiple benefits including flexibility in pricing, so hardware prices are linked to subscription services. For example, lower hardware prices are offset by longer subscriptions and vice versa. So lower cost smart phones are offset with longer term or higher priced subscriptions. The business model is to create life time users and secure revenue from subscriptions, advertising and online shopping. The content driven ecosystem will also allow cross sector promotion and greater selling diversification. With integrated products and service range propositions expanding across industries. This flexibility in pricing and digitalisation blurs the boundaries between industries and expands the data they can access, analyse and create highly targeted and effective digital services to a consumer seemingly always hungry and willing for more.

How the West competes with the Far East will continue to play out but generating similarly scaled digital business models is still someway away, with only Google, Apple, Facebook and Amazon on a similar path and needing a global audience rather than just a US centric model. Regardless, the global battle to get human screen time continues and is set to take on a whole new look within the next 5 to 10 years – so get your VR goggles and hang-on.