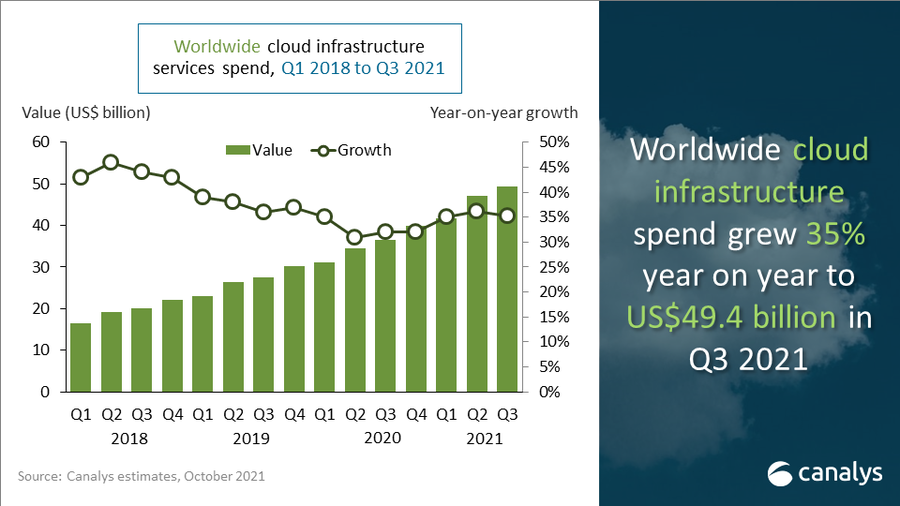

Cloud infrastructure services continued to be in high demand in Q3 2021. Worldwide spending increased 35% to US$49.4 billion, driven by a range of factors, including on-going remote working and learning, and the growing use of industry-specific cloud applications.

The latest Canalys estimates show expenditure has grown US$12.9 billion over Q3 2020 and US$2.4 billion since last quarter. Cloud services spending is still being affected by the digital transformation efforts required to maintain business continuity during pandemic-related disruptions.

In response, the major cloud services providers have emphasized geographic data center expansion to meet rising demand. But the impact of the global chip shortage is imminent, as data center component providers are seeing longer lead times and higher prices that will be passed on to the largest providers. The hyperscalers have now shifted focus to advancing industry-specific service portfolios and growing their channels to successfully bring these increasingly diverse sets of products to market.

“Overall compute demand is out-growing chip manufacturing capabilities, and infrastructure expansion may become limited for the cloud service providers,” said Canalys Research Analyst Blake Murray. “Besides managing supply chains to the best of their abilities, the providers building an advantage are focused on developing their go-to-market channels along with their product portfolios to catch up with an increasingly wide variety of customer use cases that has fueled demand since the start of the pandemic.”

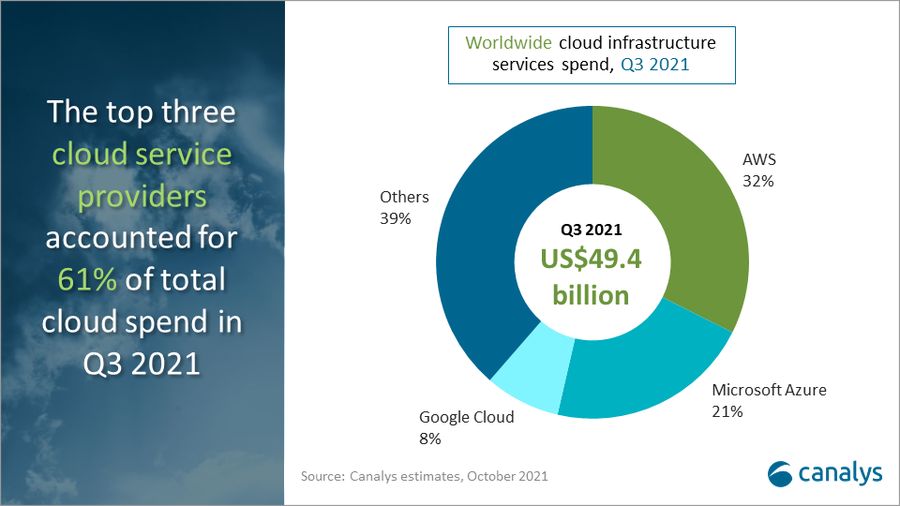

Amazon Web Services (AWS) accounted for 32% of total cloud infrastructure services spend in Q3 2021, making it the leading cloud service provider. It grew 39% on an annual basis.

AWS recently announced AWS for Health, which combines industry-specific offerings with cybersecurity and compliance solutions. It has been successful in the public sector, winning key deals with US and UK governments. It has also led channel development through its competency programs, with its government competency becoming the largest industry-focused competency among its partners.

Microsoft Azure was the second largest cloud service provider in Q3, with a 21% market share. It grew over 50% for a fifth consecutive quarter.

Microsoft continued to focus on industry cloud service customizations and expanded capabilities in financial services and manufacturing. It also reported new customer success in its cloud service suites for healthcare and sustainability. Microsoft has worked on its position around data governance and also announced Azure Purview, a unified data solution designed to support data management in multi-cloud environments.

Google Cloud was the third largest provider and grew 54% to account for 8% of the market. It announced 20 expanded technology partnerships with data and cybersecurity companies to deepen vertical expertise. Google Cloud has also emphasized its channel partners and released new incentives in its partner program.

It advertised a 175% increase in customer engagements through partners during the first half of 2021. It also advanced its positioning around data sovereignty with the release of Google Distributed Cloud, which gives customers options to extend Google Cloud’s infrastructure to the edge and customer data centers.