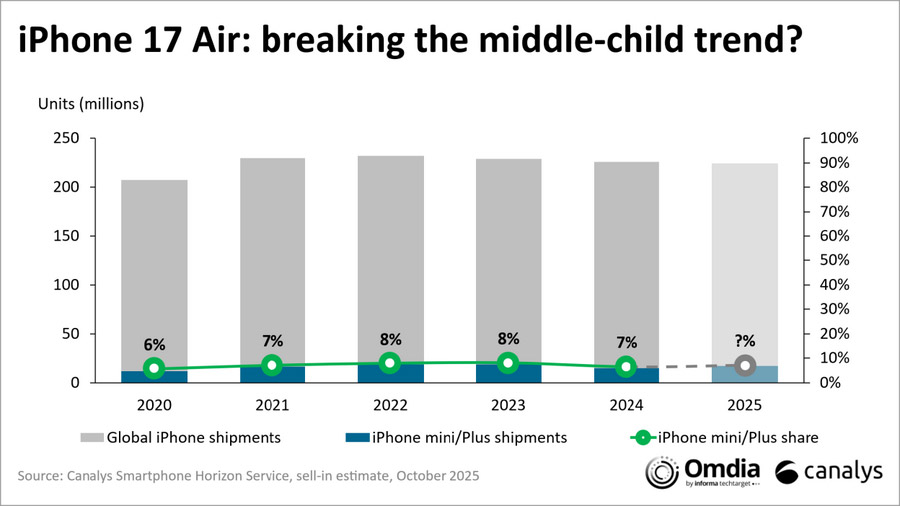

Apple’s mid-tier iPhone experiments, such as the mini and Plus, have historically underperformed according to e Xuan Chiew, Research Manager at Canalys (part of Omdia)

The anticipated iPhone 17 Air signals a strategic shift. By elevating slimness as a premium attribute—rather than relying on the Plus model’s larger display—Apple can retire its weakest-selling variant while strengthening its portfolio evolution strategy. This mirrors the company’s Mac playbook, where the Air line complements the Pro series as a distinct, aspirational tier.

From a portfolio management perspective, the Air could serve three critical functions:

Strategic testbed – The slim design demands higher-cost engineering, production, and materials—making it difficult for cost-focused rivals to replicate. For Apple, the Air can act as a proving ground for ultra-thin form factors, laying the foundation for a thinner, more durable foldable iPhone at the ultra-premium tier.

Premium portfolio support – Positioned as a complement to the high-end Pro models instead of a budget flagship volume driver, the Air reinforces Apple’s premium image while offering consumers a distinct design-led alternative.

Margin optimization – Occupies a mid-price band that balances volume with profitability, capturing demand from both developed and emerging markets without direct cannibalization.

What is the impact of the US–China trade war on Apple, and what are the strategic implications for its supply chain and pricing?

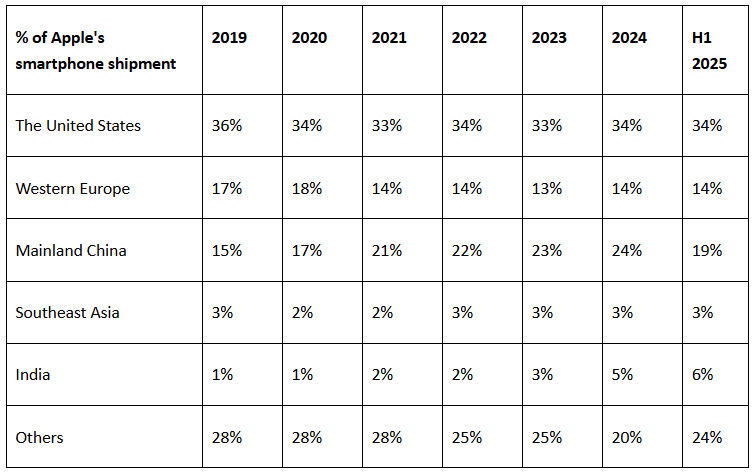

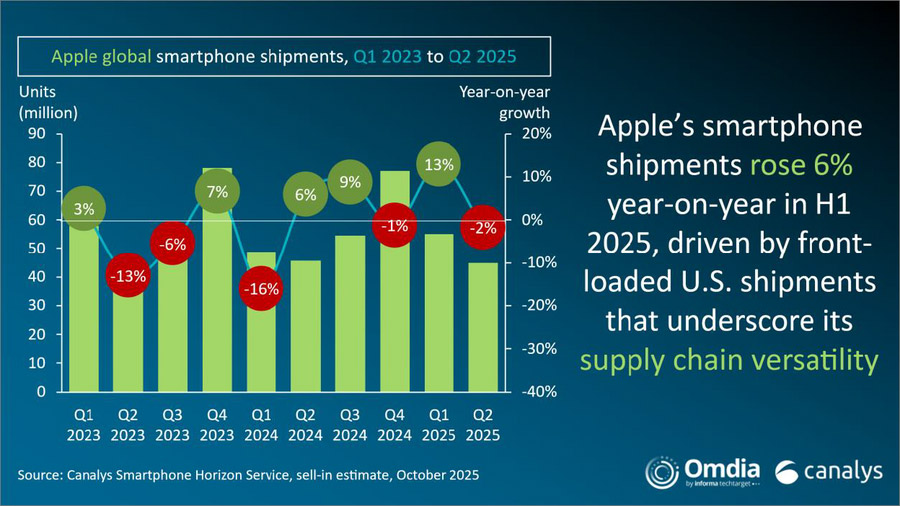

Apple is navigating a delicate balance between its two largest markets—the U.S. and China—amid rising trade tensions. Tariffs have already added an estimated US$900 million in costs, with expectations of surpassing US$1 billion in Q3 2025. Concurrently, a weakening U.S. dollar is heightening pricing pressures. While global list prices are expected to remain relatively stable, Apple is likely to raise U.S. launch prices to offset tariff-related costs. Furthermore, a weaker U.S. dollar now allows Apple to increase prices in the US while maintaining competitive pricing abroad—something that wasn’t possible for the iPhone 14 and 15, when a stronger dollar constrained pricing flexibility. Strategically, this highlights Apple’s emphasis on supply chain diversification, regional pricing management, and margin protection as it navigates intensifying trade frictions.

Canalys (part of Omdia)estimates indicate a major realignment in Apple’s global supply chains: iPhone shipments from India to the U.S. surpassed 11 million units in Q2 2025, compared with roughly 3 million from China. Nearly half of all iPhones sold in the U.S. last quarter were assembled in India, with Foxconn leading production and Tata rapidly scaling operations following the Wistron acquisition. This shift underscores the pivotal role of India in Apple’s strategy to mitigate trade risk and maintain operational resilience.

How can Apple ensure its software capabilities keep pace with hardware maturity?

While Android competitors have aggressively advanced AI integration—including generative AI and AI-powered assistants—Apple’s slower rollout of first-party AI features has created adoption gaps. This has contributed to delayed upgrades among some users and could pose longer-term challenges.

AI adoption overall is accelerating rapidly. By the end of 2025, one in four smartphones is expected to be AI-capable, up from just 9% last year, while AI-related app downloads have already surpassed 1 billion. Clearly, users are demanding more AI in their daily experiences.

Apple’s perception as being “late to the AI party” presents a significant challenge. While its focus on privacy and on-device processing remains a competitive advantage, this value proposition needs to be communicated more effectively to reinforce user trust and adoption.

In China, a key market, Apple holds ~40% of the AI-capable smartphone segment, yet the absence of built-in Apple Intelligence drives users to third-party apps like Doubao (101M App Store downloads). Without accelerated AI deployment, Apple risks ceding ground to local Android brands with deeper software integration.

The iPhone 16e, intended to replace legacy models, highlights this issue. While adoption is strong in developed markets such as Europe and Japan, uptake in emerging markets lags—primarily due to the lack of Apple Intelligence features—underscoring the urgency for software-driven differentiation alongside hardware innovation.

How is Apple’s AI integration driving its IoT market leadership?

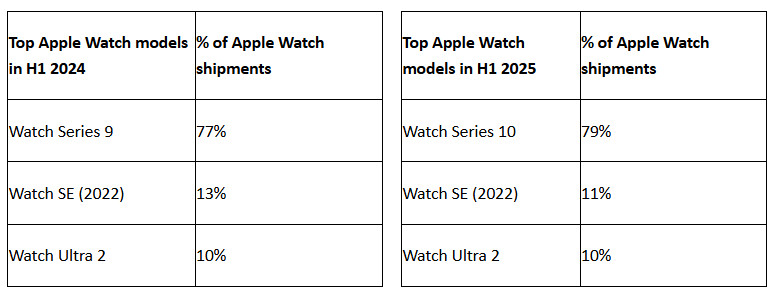

Apple continues to reinforce its IoT leadership by embedding AI across its product ecosystem, enhancing user experience, data security, and ecosystem cohesion. At the upcoming “Awe Dropping” event, the company is expected to unveil a redesigned, larger-screen Apple Watch, highlighting tighter integration with AirPods and a focus on health tracking—strengthening its dominance in wearables.

Canalys (part of Omdia) data underscores Apple’s leadership in attach rates, which drives profitability, brand loyalty, and recurring service revenue. New Apple Intelligence features are anticipated to enable advanced personalization, transformative health tracking, and more engaging user interactions. By leveraging AI to deepen ecosystem synergies, Apple is further solidifying its competitive advantage in the rapidly evolving AI-driven IoT landscape.

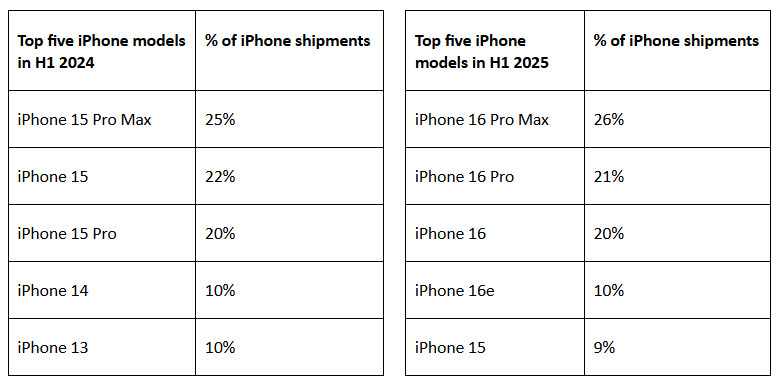

Some key Canalys (part of Omdia) data points on Apple:

- iPhone historical shipments and average selling price:

- 2020: 207.2 million units (+5%), US$788 (-3%)

- 2021: 230.1 million units (+11%), US$952 (+21%)

- 2022: 232.2 million units (+1%), US$932 (-2%)

- 2023: 229.1 million units (-1%), US$1,039 (+12%)

- 2024: 225.9 million units (-1%), US$1,068 (+3%)

- 2025 H1: 99.8 million units (+6%), US$1,054 (-1%)