Amidst a backdrop of market volatility, changing investor sentiments, and sector-specific nuances, the Asia-Pacific (APAC) venture capital (VC) investment ecosystem witnessed a unique trend during the first half (H1) of 2023.

During this period, deals of all funding sizes declined, whereas billion-dollar deals remained notably absent, signaling a strategic shift in the investment dynamics of the region, observes GlobalData.

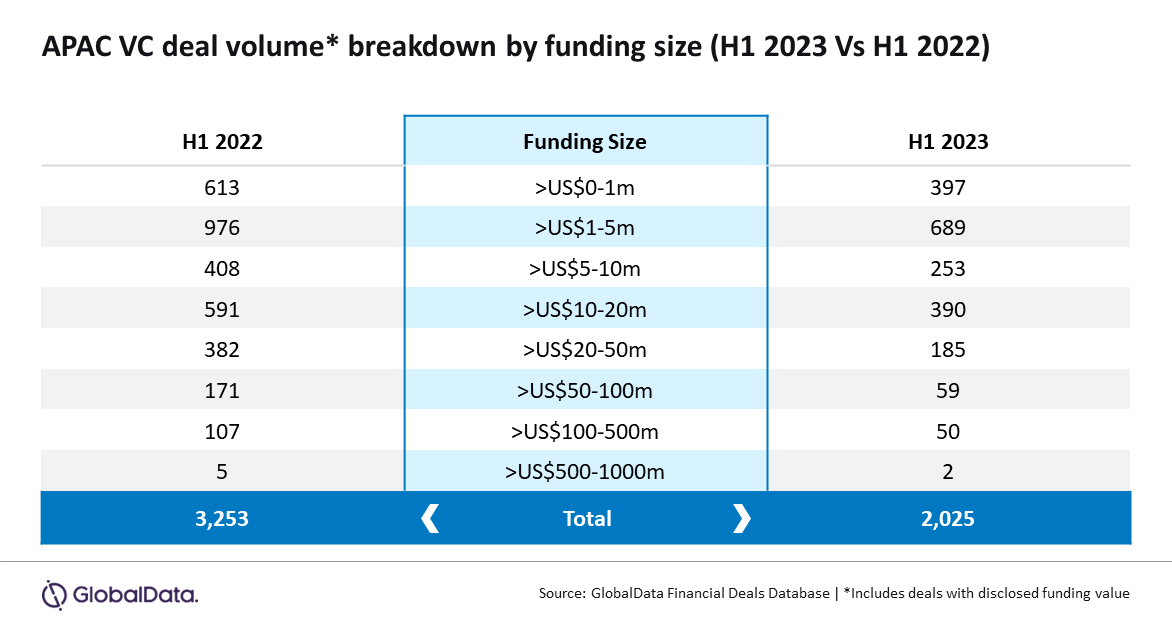

An analysis of GlobalData’s Financial Deals Database reveals that a total of 2,025 VC funding deals with disclosed funding value were announced in APAC during H1 2023, which is a decline of 37.7% over the 3,253 VC deals announced during H1 2022.

Aurojyoti Bose, Lead Analyst at GlobalData, comments: “Akin to the global trend, deal volume across all funding sizes declined in H1 2023 compared to H1 2022 for the APAC region as investor sentiments have taken a hit amid volatile market conditions.”

Billion-dollar deals remained non-existent in H1 2022 while H1 2023 also did not see announcement of any such deals. Further, the number of high-value deals (valued more than $100 million) also declined significantly in H1 2023 compared to H1 2022.

The number of high-value deals declined by 53.6% year-on-year (YoY) from 112 to 52. Meanwhile, high-value deals accounted for a mere 2.6% share of the total number of VC deals with disclosed funding value announced in the APAC region during H1 2023.

Bose explains: “The conspicuous absence of billion-dollar deals and fall in volume of high-value deals underscore a strategic recalibration within the VC investor community, where cautious maneuvers are being observed in response to an intricate tapestry of market volatilities and sector-specific dynamics.”

Low value* deals accounted for 66.1% share of the total number of VC deals with disclosed funding value announced in the APAC region during H1 2023. The volume of low-value deals declined by 32.9% from 1,997 to 1,339.

Mid-size funding deals (valued more than $10 million and ≤ $100 million) volume also declined by 44.6% YoY from 1,144 to 634. These deals accounted for 31.3% share of the total number of VC deals with disclosed funding value announced in the APAC region during H1 2023.

Bose concludes: “As investors navigate the terrain of uncertainty, the absence of high-value transactions beckons both investors and observers to delve deeper into the evolving factors that are orchestrating this unique shift in the regional investment landscape.”

*Investment value ≤ $10 million.