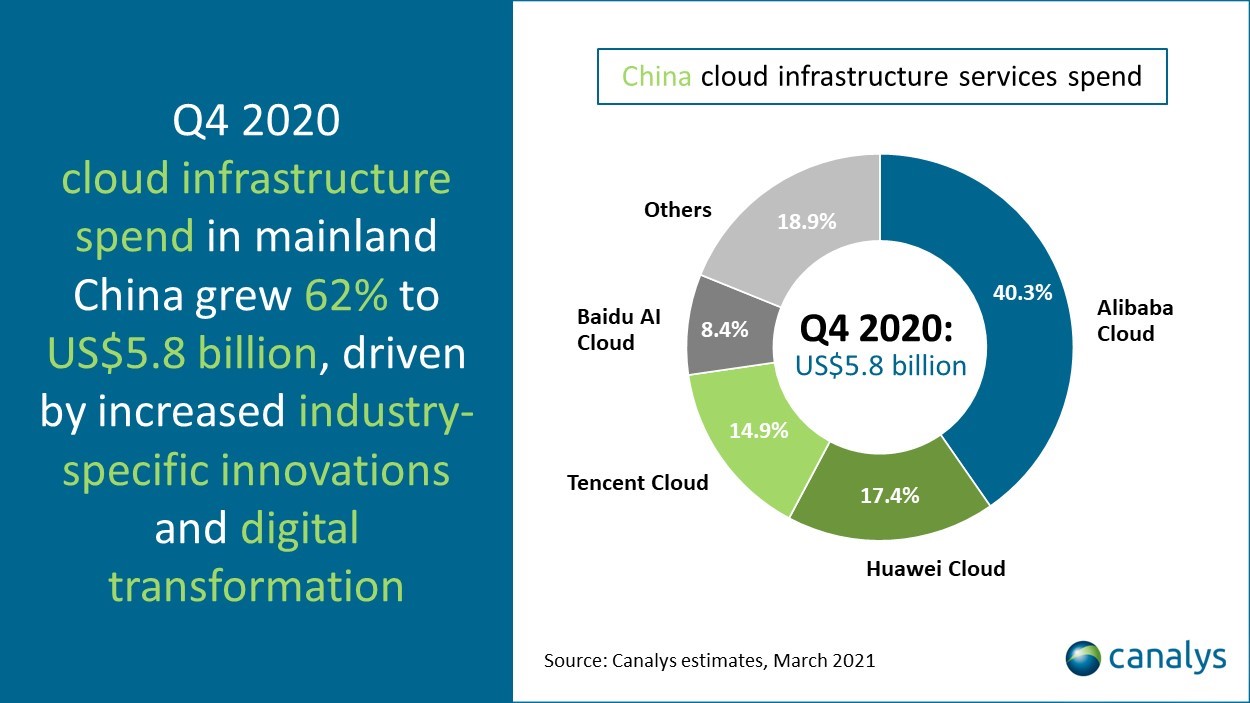

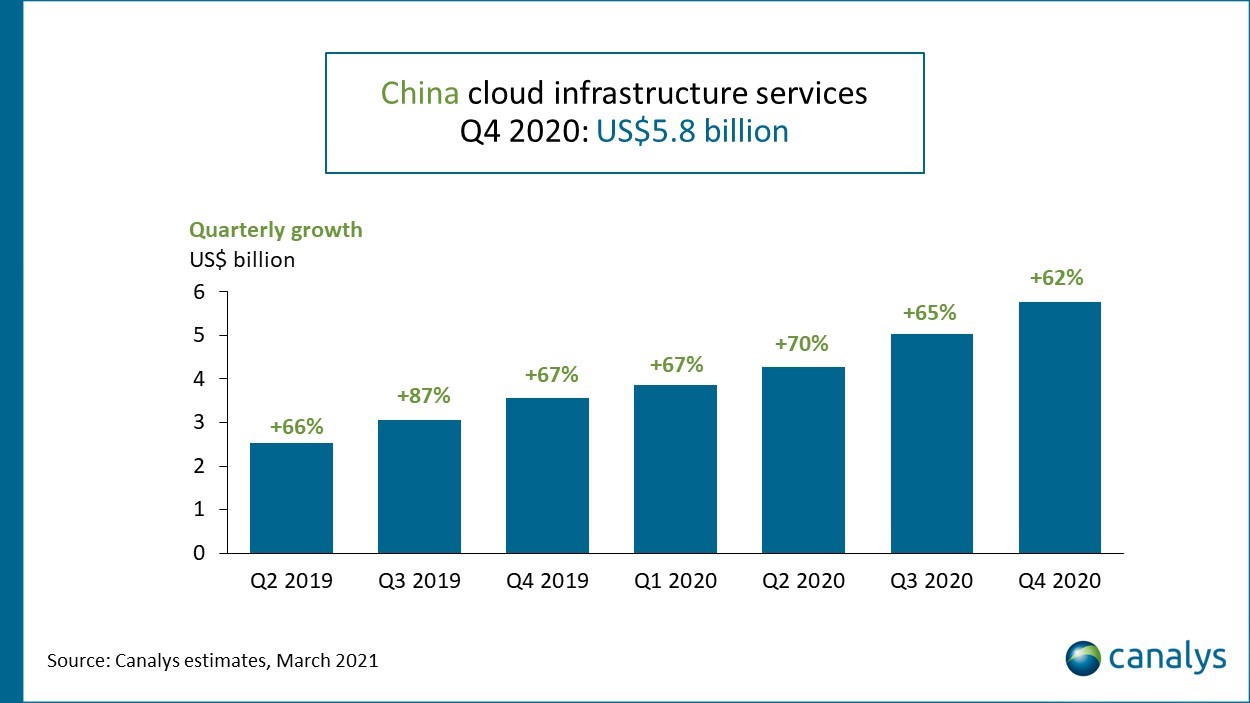

Cloud infrastructure services spend in China grew 62% in Q4 2020 to US$5.8 billion. Total expenditure broke a new record with an increase of US$2.2 billion compared to Q4 2019 and US$740 million over last quarter according to the latest Canalys data. The dollar-for-dollar annual expansion was the highest ever recorded, indicating robust demand for cloud services. The focus on digital transformation following the COVID-19 pandemic, combined with rapid economic recovery and subsequent restart of some delayed projects were the main factors in the continued momentum of investment. Growth in cloud infrastructure services in China continued to outpace the rest of the world, with the government making it one of its top strategic priorities. Overall, it was the second largest market after the US, accounting for 14% of global investment, up from 12% in Q4 2019. The top four cloud service providers were Alibaba Cloud, Huawei Cloud, Tencent Cloud and Baidu Cloud, which collectively accounted for over 80% of total spending.

For full-year 2020, total cloud infrastructure services spending in China grew 66% to US$19 billion, up from US$11.5 billion in 2019. “Remote learning and working, as well as gaming, streaming, ecommerce and other online services were key areas driving consumption of cloud infrastructure services in China throughout 2020,” said Canalys Chief Analyst Matthew Ball. “Cloud service providers also played a pivotal role in developing digital services to support organizations in overcoming challenges caused by the COVID-19 pandemic, and these relationships will lead to larger transformation projects going forwards. In the coming year, consumption of cloud services will maintain robust growth, driven by continued expansion of online services and digitalization of processes and operations within enterprises and government organizations.”

Alibaba Cloud was the market leader with 40% share. It reported growth in Internet, retail and public sectors. Hybrid cloud is a key focus in 2021, following the launch of its Hybrid Cloud Partner Program and on-premises appliances. Huawei Cloud ranked second with 17% market share. It made progress with e-Gov clouds, as well as Internet, genomics, automaker, and financial services accounts, while expanding its ecosystem of consulting partners and developers. It also launched its Cloud Native 2.0 initiative to enable cloud native development within enterprise and government customers. Tencent was third with 15% share. It saw rising demand in government, finance, healthcare and education sectors. Enterprise expansion is a key focus, with developer enablement initiatives to help identify and deploy cloud-native services. Baidu AI Cloud was the fourth largest cloud service provider, accounting for 8% of total spend in Q4 2020. It was boosted by growth in government, enterprise, Internet, transportation, healthcare and financial sectors.

“Customers are requiring more advanced solutions from cloud service providers to meet data security requirements and other industry-specific needs. The pace of innovation is accelerating in China as customers become more integrated and dependent on cloud-based services, particularly for AI and data processing. This is accelerating the development of data center capacity, connectivity and data services,” said Canalys Research Analyst Blake Murray. “This year will bring a growing opportunity for cloud service providers to demonstrate value across specific industries and across specific complexities of hybrid-cloud and cloud-native deployments. Demonstrating value will remain critical to building trust between customers and cloud service providers while innovation will drive the competitive edge between providers.”

Canalys defines cloud infrastructure services as services that provide infrastructure as a service and platform as a service, either on dedicated hosted private infrastructure or shared infrastructure. This excludes software as a service expenditure directly, but includes revenue generated from the infrastructure services being consumed to host and operate them.