According to Canalys estimates, cloud infrastructure services spend in mainland China grew 6% year-on-year in Q1 2023, reaching US$7.7 billion and accounting for 12% of global cloud spend.

Demand for cloud migration remained sluggish, with single-digit growth persisting for a third consecutive quarter.

Easing pandemic restrictions which reduced the need for remote work and online meetings; enterprises cautious with IT budgets; plus the slowdown in cloud consumption by existing customers, and limited cloud investments from new customers, all resulted in mainland China’s cloud market growth rate decelerating.

However, as ChatGPT sets off a wave of demand for AI, generative AI and AI Foundation Models are becoming highly sought after, and this is expected to unlock new growth opportunities in the cloud service market.

Enterprises in mainland China have shown limited enthusiasm when it comes to cloud adoption, predominantly focusing on the operational cost benefits cloud brings.

A number of Chinese cloud vendors recently announced price reductions for their cloud services, with the goal of lowering the entry barrier for cloud adoption.

More vendors are also starting to invest further in building cloud partner ecosystems. Cloud partners can help vendors cost-effectively access a wider customer base, particularly among small and medium-sized enterprises (SMEs).

“In addition to reducing technical costs, cloud vendors are also proactively lowering prices to increase market share,” said Canalys Research Analyst Yi Zhang. “When there is a lack of incremental market demand, reducing prices can appeal to price-sensitive customers.”

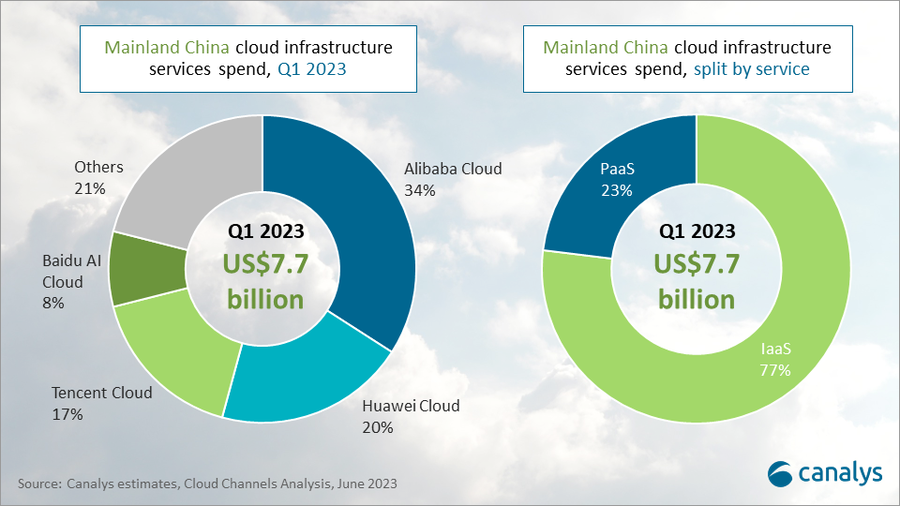

The leading players in mainland China’s cloud infrastructure market remained unchanged in Q1 2023, with Alibaba Cloud, Huawei Cloud, Tencent Cloud, and Baidu AI Cloud maintaining their positions as the top four cloud vendors.

Together, they accounted for 79% of total expenditure in mainland China, with an increase of 6% year-on-year.

While the focus on PaaS product portfolios has been increasing among many vendors since last year, mainland China’s cloud services market is still dominated by Infrastructure-as-a-Service (IaaS).

In Q1 2023, IaaS accounted for over three-quarters of the overall mainland China cloud services market.

Alibaba Cloud remains the market leader, accounting for 34% of the mainland China cloud market. While its position remains strong, Alibaba Cloud’s market share declined slightly. It decreased by 2% this quarter, marking its first year-on-year decline in revenue. The decline can be attributed to the delayed delivery of hybrid cloud projects. Nonetheless, Alibaba Cloud is actively pursuing new avenues for growth. In April, the company announced a comprehensive price reduction of 15% to 50% for its core products. It also introduced a new partner program, cooperating with partners to drive the adoption of its AI Foundation Model service “Tongyi Qianwen” in various verticals services.

Huawei Cloud emerged as the second-largest cloud vendor in mainland China, capturing 20% of the market share following a 19% year-on-year growth. Compared to Q1 2022, Huawei Cloud’s market share increased by 2%. The company’s investment in its partner ecosystem has contributed to this growth, surpassing the overall market’s growth for the third consecutive quarter. In March, Huawei Cloud unveiled a plan to invest CNY100 million (US$14.5 million) to attract more partners to join its cloud ecosystem in 2023.

Tencent Cloud secured a market share of 17%. It is expected to regain stability in cloud services growth as the impact of its internal business restructuring diminishes. In May Tencent Cloud followed Alibaba Cloud’s April price reduction, by announcing price reductions for core cloud products, including networking and databases. The maximum reduction for some products is expected to reach 40%, signifying Tencent Cloud’s ambition to capture more market share.

Baidu AI Cloud experienced a marginal 1% decline in revenue due to internal business adjustments and currently holds an 8% market share. As a vendor that has consistently adopted a strategy of integrating AI technology with cloud services, Baidu AI Cloud found new opportunities with its AI Foundation Models and AICG (AI Content Generation) solutions. In March, Baidu AI Cloud witnessed sales leads growing by over 400% year-on-year, indicating the positive impact of these offerings.