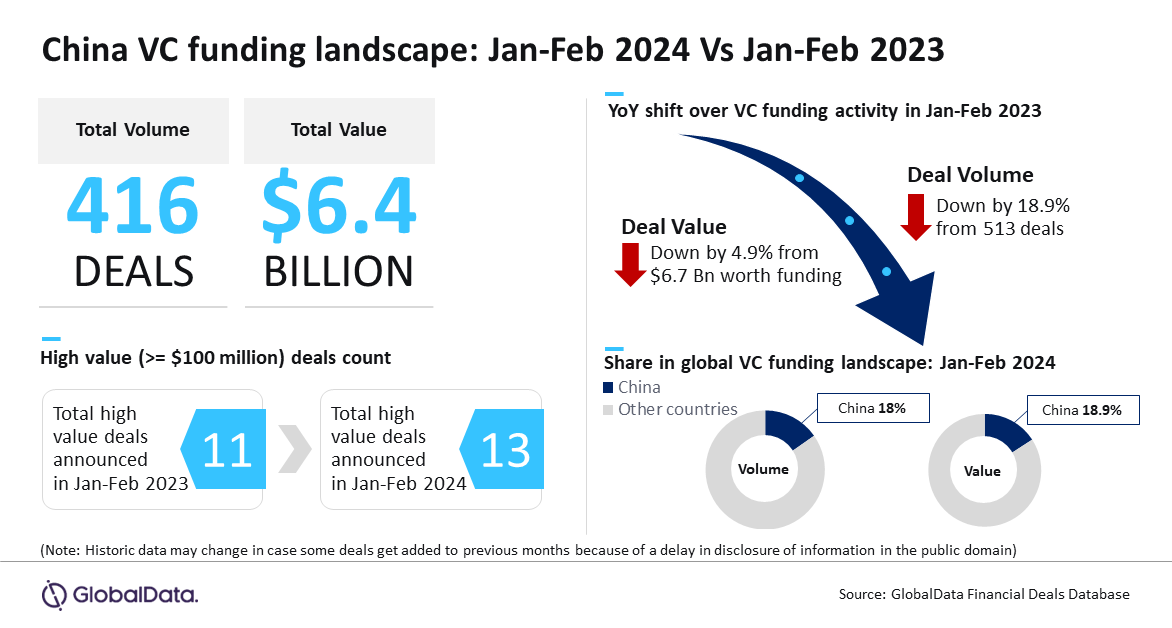

China witnessed the announcement of a total of 416 venture capital (VC) funding deals of worth $6.4 billion during the first two months of year 2024, which is a year-on-year (YoY) decline of 18.9% in terms of deal volume and 4.9% in terms of funding value, reveals GlobalData.

An analysis of GlobalData’s Deals Database reveals that Chinese startups raised $6.7 billion worth of venture funding through 513 VC deals during the same period in 2023.

Aurojyoti Bose, Lead Analyst at GlobalData, comments: “The YoY decline in terms of funding value is relatively lesser compared to decline in deal volume during January-February 2024. This could be attributed to the month-on-month (MoM) growth in funding value experienced in February. China witnessed 12.8% MoM growth in funding value in February 2024. In fact, China saw the announcement of 2024’s first billion-dollar in February.”

Big-ticket VC funding deals announced in China during February 2024 included $1 billion worth of funding raised by Moonshot AI, $933 million worth funding raised by Shanghai Spacecom Satellite Technology, and $140 million secured by Shenzhen Jinming Industrial, among others.

Bose adds: “China’s attractiveness can also be understood from the fact that apart from being the top Asia-Pacific market, it also continues to be a key global market for VC funding activity and stands just next to the US in terms of both deal volume and value.”

China accounted for 18% of the total number of VC deals announced globally during January-February 2024 while its share in terms of disclosed funding value stood at 18.9%. Moreover, China has seen the creation of five unicorns in the country during the first two months of 2024.

Bose concludes: “Despite fluctuations in deal volume, the sustained momentum in funding value and the emergence of unicorns signify China’s robust entrepreneurial ecosystem. As the country navigates through dynamic market conditions, its position as a powerhouse in VC funding remains unwavering.”