Cloud infrastructure services spending in mainland China grew 22% year on year in Q4 2023, according to Canalys estimates, reaching US$9.7 billion and accounting for 12% of worldwide cloud spend.

In 2023, China’s cloud service market grew by 16% overall, up from 10% in 2022. Canalys expects growth to accelerate further in 2024, with Chinese cloud infrastructure services spending set to increase by 18%.

Enterprises will re-ignite cloud investments as they move beyond a phase of IT optimization, while the surge in Generative AI will drive increased cloud consumption.

Meanwhile, significant price cuts implemented by Chinese cloud service providers have helped drive adoption by more cost-conscious customers, exacerbating the competitiveness within the market.

To differentiate themselves amid the escalating price battles, cloud vendors will emphasize elevating service standards, fostering innovation and refining the overall cloud service ecosystem.

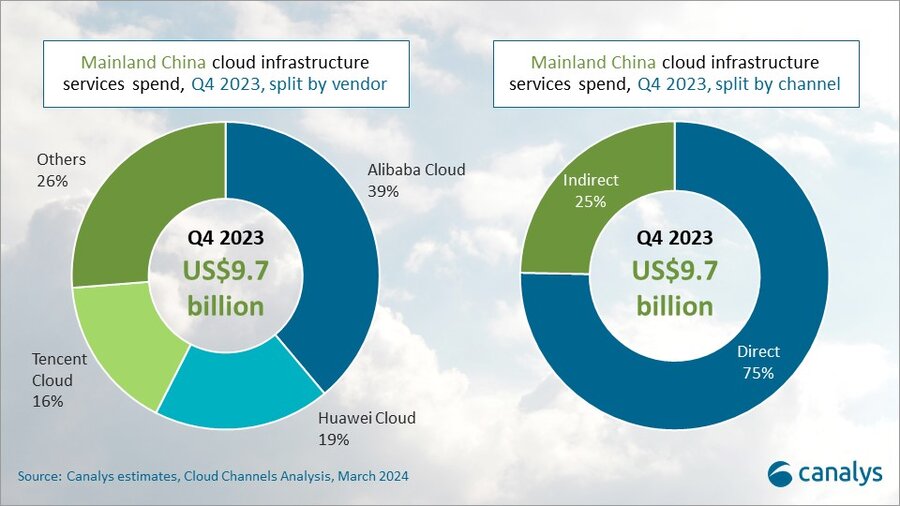

In Q4 2023, the leading trio in China’s cloud service market, Alibaba Cloud, Huawei Cloud and Tencent Cloud, sustained their dominance, achieving collective growth of 28% and securing 74% of the total market.

All three are placing greater emphasis on developing their partner ecosystems to fuel growth, with both Huawei Cloud and Tencent Cloud hosting partner summits since the start of the year.

Cloud revenue generated through the channel accounted for 25% of total revenue in the Chinese market in Q4 2023, and this proportion is expected to increase.

In 2023, Huawei Cloud maintained consistent double-digit growth, while Tencent Cloud showed signs of revenue growth accelerating following its profit optimization cycle.

Alibaba Cloud, however, faced challenges and its growth was more subdued. A potential contributing factor could be the frequent restructuring within Alibaba Cloud’s organization over the past year.

Amid sluggish growth, cloud vendors implemented price reductions to improve customer acquisition and retention.

Alibaba Cloud initiated price cuts in April 2023, sparking similar moves from competitors such as Tencent Cloud and China Telecom in May 2023. In February 2024, Alibaba Cloud implemented another round of price reductions, aiming to attract a broader clientele through its low-cost strategy.

“Cloud vendors are currently faced with the dual challenges of maintaining revenue growth and sustaining profitability amid competitive pressures driving price reductions,” said Yi Zhang, Analyst at Canalys. “Meanwhile, Generative AI continues its rapid progress, increasing demands on cloud vendors. Beyond profitability concerns, they must also ramp up investments in emerging technologies. In such cases, effective collaboration with partners can help mitigate risks and gain access to partners’ expertise and resources. This will allow them to navigate competitive pressures and foster sustainable growth in the AI-powered future.”

Alibaba Cloud maintained its leading position in the Chinese cloud market in Q4 2023, with a market share of 39%, but growth slowed to just 3% year on year. This moderation partly stemmed from Alibaba Cloud’s proactive reduction of contracts with lower profits. Throughout 2023, Alibaba Cloud’s revenue growth remained in the single digits (excluding the effects of statistical adjustments). In a strategic move to reignite growth, Alibaba Cloud announced a 55% price reduction for more than 100 of its core cloud products in February 2024. This initiative targets a broader customer base, particularly small and medium-sized businesses. Concurrently, there was a structural reorganization within Alibaba Cloud’s sales management team at the end of 2023. This shift could potentially introduce new dynamics to its channel development.

Huawei Cloud maintained its position as the second-largest cloud vendor in mainland China, with a market share of 19%. In Q4 2023, Huawei Cloud achieved a year-on-year growth rate of 23%. Throughout 2023, Huawei Cloud’s revenue increased by 17% compared with 13% in 2022, showing consistent performance across quarters and steadily closing the gap on its competitor Alibaba Cloud. Demonstrating its commitment to the channel, Huawei Cloud hosted a Huawei Cloud Partner Conference in January 2024, where it revealed that over 150 partners had generated sales exceeding CNY10 million (US$1.4 million) with Huawei Cloud. In 2024, Huawei Cloud will prioritize partner development by enhancing the Cloud Solution Provider Program and Distribution Partner Program alongside new customer and partner annual growth incentives.

Tencent Cloud achieved 27% revenue growth in Q4 2023, reaching a market share of 16%. This increase indicates that Tencent Cloud has successfully navigated the phase of adjusting profitability, with its growth stabilized once again at double-digit levels. Tencent Cloud’s investments in its partner ecosystem development are beginning to show results. By January 2024, partners drove 90% of sales for Tencent Meeting, its core SaaS product, with top partners achieving triple-digit growth in performance. During its Industry Partner Conference, held in January 2024, Tencent Cloud further committed to partner success by unveiling plans to immediately share 30% of its direct sales leads with partners, with an aim to reach 50%.

Canalys defines cloud infrastructure services as services that provide infrastructure-as-a-service and platform-as-a-service, either on dedicated hosted private infrastructure or shared public infrastructure. This excludes software-as-a-service expenditure directly, but includes revenue generated from the infrastructure services consumed to host and operate them.