The total addressable market size of enterprise storage in China, in terms of spending opportunity, is poised to reach US$15.7bn in 2025, driven by the growing demand for secured, enhanced and faster storage solutions among the enterprises shifting towards digital infrastructure, says GlobalData.

GlobalData Market Opportunity Forecasts to 2025: ICT in China reveals that innovations in storage solutions such as software-defined storage, high performance capabilities, and faster access to data that can handle next-generation workloads for big data, artificial intelligence and virtual infrastructure will boost enterprise storage market in the country over the next few years.

Saurabh Daga, Technology Analyst at GlobalData, comments: “As enterprises increase their investments in disruptive technologies like big data, artificial intelligence, automation and blockchain as part of their digital transformation initiatives, the need for storage power necessary to capture huge data sets will increase going forward, helping drive enterprise storage spending in China to increase at a CAGR of 9.9% over the forecast period 2020-2025.”

China has emphasised on digital infrastructure spending within its ‘New Infrastructure Plan’, a five-year plan for accelerating the implementation of key technologies, which also includes 5G networks, industrial Internet, data centers, and artificial intelligence, all of which require a significant investment on upgrading the storage infrastructure.

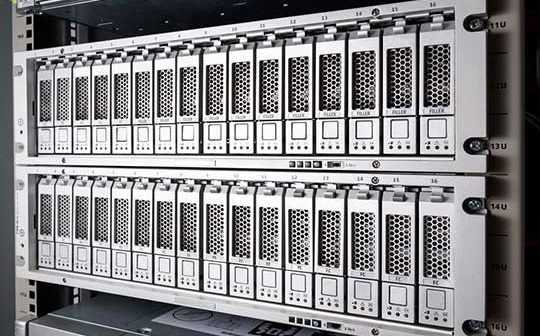

Among the enterprise storage segments comprising hardware, software and managed storage services, enterprise spending on storage hardware is set to grow at the fastest CAGR of 11.7% over 2020-2025. Network attached storage (NAS), all flash and hybrid arrays, and storage area network (SAN) represent the top-three enterprise storage hardware categories in 2021, in terms of market size.

Mr Daga continues: “With phasing out of legacy tape storage, and capability maturation of hard-disk drives, the NAS storage is witnessing a surge in demand as it provides an efficient and scalable storage access for a distributed team from a centralized location. The growing popularity of NAS storage among the Chinese enterprises is also because the data access can be centrally controlled, a key feature considering the strict data security regulations in the country.”

Software-defined storage will account for second largest share of the overall enterprise storage opportunity through the forecast period. The need for simplified, scalable and cost-efficient storage infrastructure will drive the demand for software-defined storage among the enterprises in China.

Mr Daga concludes: “While the large enterprises segment (1,001+ employees) will account for largest share of the total enterprise storage spending in China through the forecast period, the combined spending from micro (1-50 employees), small and medium (51-1,000 employees) enterprises will increase at a marginally faster CAGR of 9.9% over the forecast period. The increasing trend of digitalization among SMEs in China and the institutional support to them in the form of easy loans and tax incentives on technology implementations and R&D will be the key drivers for growth in this segment.”