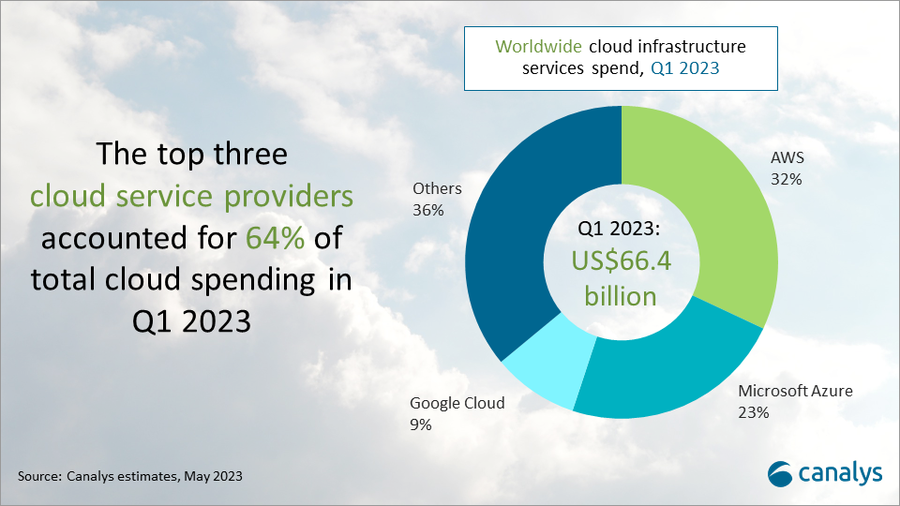

Worldwide cloud infrastructure services spending increased 19% to US$66.4 billion in Q1 2023.

While cloud remains one of the fastest-growing segments of the IT market, customer investments continue to slow in the face of persistent macroeconomic uncertainties, with growth falling below 20% for the first time.

Enterprises are reducing cloud spend as part of overall cuts to IT budgets, with a clear emphasis on optimizing cloud costs, gaining control over cloud wastage, and improving the efficiency of cloud deployments.

All the cloud hyperscalers were adversely affected, with their growth falling by four percentage points from the previous quarter.

The top three hyperscalers, AWS, Microsoft Azure and Google Cloud, collectively grew 22% (compared to 26% in Q4 2022) to account for a 64% share of customer spending in Q1 2023. In response to slowing growth, they announced staff layoffs and other internal cost cuts in their cloud divisions.

Regionally, APAC saw the weakest performance as customer spending reduced in Mainland China, impacting many of the Chinese hyperscalers.

Canalys expects global cloud services spending to continue to be slow through the second half of 2023.

A focus by customers of all sizes on cloud optimization is fueling interest in observability technologies, FinOps solutions and AI.

The purpose is to improve the visibility of usage, drive better utilization and strengthen cloud management.

It is also encouraging more businesses to repatriate certain cloud workloads for cost benefits and greater control.

This brings opportunities for channel partners to provide professional and managed services in these segments, as customers seek to build, secure and manage complex hybrid cloud environments.

“Enterprises are benefiting from the hybrid cloud model, but moving workloads between on-premises and cloud platforms can be costly for them,” said Alex Smith, VP at Canalys. “Increased reliance on complex cloud environments may result in challenges when it comes to managing them, but there are supporting technologies that can play a big role in identifying efficiencies and streamlining processes, especially in automating routine tasks and analytics.”

“Cloud service providers are finding ways to add value to their customers by introducing AI components,” said Yi Zhang, Research Analyst at Canalys. “This trend is expected to grow where AI can streamline and enhance workflows within enterprises.”

At the same time, the rapid adoption of new, compute-intensive applications like generative AI is set to create massive global demand for public cloud capacity, which will help the hyperscalers to offset some of the weakness experienced in enterprise spend over the next few quarters.

Amazon Web Services (AWS) was the leading cloud service provider in Q1 2023, accounting for 32% of total spending after growing 16% year-on-year, dropping below the 20% growth mark for the first time, according to Canalys estimates.

AWS announced employee layoffs in response to tough market conditions. As more companies started to incorporate generative AI technology into their existing tech stack, AWS was not one to be left behind. It launched Amazon Bedrock, a suite of cloud-based AI tools to rival its competitors.

Announcements from AWS show a focus on the APAC region, with the launch of a second AWS center in Australia and plans to open a new center in Malaysia.

Microsoft Azure remained the second largest cloud service provider in Q1 2023, with a 23% market share after it grew by 27% year-on-year. Business performance is expected to remain steady as its backlog commitment increased to US$196 billion in Q1 2023.

During the quarter, Microsoft announced the general availability of Azure OpenAI services, enabling more customers to build high-performance AI services on Azure. The combination of AI technology and cloud services paved new opportunities for Azure.

It won more than 2,500 Azure OpenAI service customers including Coursera, Mercedes-Benz and Shell, growing its clientele size tenfold since last quarter.

Regarding capital investments, there were announcements on establishing a new data center in Saudi Arabia, offering organizations in Saudi Arabia local data residency and faster access to the cloud.

Google Cloud grew 30% in the latest quarter and accounted for 9% market share. Its cloud business achieved profitability for the first time.

Google Cloud’s initiative to extend its equipment lifecycle, which was announced last quarter, resulted in cost-efficiency gains, and it plans to optimize external procurement processes in the next few quarters to further improve profitability.

It continues to bring generative AI advances to its cloud customers across its product portfolio. Google Cloud is committed to expanding its partner-led, partner-delivered service approach in 2023 and the investments in building its partner ecosystem are beginning to see some success.

To date, more than 100,000 companies are part of the Google Cloud Partner Advantage Program.

Canalys defines cloud infrastructure services as those services that provide infrastructure-as-a-service and platform-as-a-service, either on dedicated hosted private infrastructure or shared public infrastructure.

This excludes software-as-a-service expenditure directly but includes revenue generated from the infrastructure services being consumed to host and operate them.