HPE has announced it has entered a definitive agreement to acquire Juniper for a cool $14 B.

In the below points, Mauricio Sanchez, Sr. Director, Enterprise Security & Networking Research, shares his key takeaways on HPE’s acquisition of Juniper.

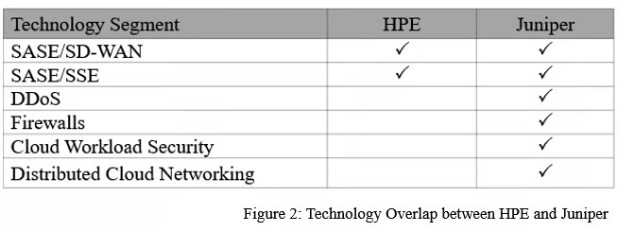

- The overlap between both is limited to SASE (Figure 2). Both have SD-WAN and SSE offerings to provide a single-vendor SASE solution.

- The overlap in SASE should be straightforward to reconcile since HPE has a much larger business than Juniper. In 3Q23, HPE was the tenth largest SASE vendor by revenue and its business was nearly four times larger than Juniper’s SASE business (which occupied the 18th revenue position).

- Outside of SASE, Juniper extends HPE’s reach into the DDoS, Firewall, Cloud Workload Security, and Distributed Cloud Networking markets.

SWOT analysis

Strengths

- Juniper brings a number of network security technology capabilities that HPE lacks.

- Juniper’s reputation in the cloud and comms service provider space will help HPE’s overall credibility.

Weaknesses

- Juniper’s network security market share is small compared to the big 3 of Cisco, Fortinet, and Palo Alto Networks

Opportunities

- Quickly align behind Axis Security for SSE for both HPE and Juniper customers to accelerate uptake. Juniper’s SSE solution relies on OEM’ed technology.

- Enable the total HPE salesforce to sell all Juniper products.

Threats

- Bungle the SASE integration and fall further behind

- HP/HPE has had a troubled past trying to sell network security. Juniper’s security business may further be marginalized.

- HPE has had a checkered past with company acquisitions (Colubris wireless, 3Com/H3C networking, TippingPoint security). Aruba has been a bright star.

HPE has scheduled analyst briefings over the next several weeks to discuss today’s news.