Amid a notable decline in global initial public offerings (IPO) activity in the first eight months of 2023, India has surged ahead.

Despite economic uncertainties and geopolitical conflicts, the country secured the top position with 152 transactions valued at $3.8 billion, driven by a robust SME IPO market, reveals GlobalData.

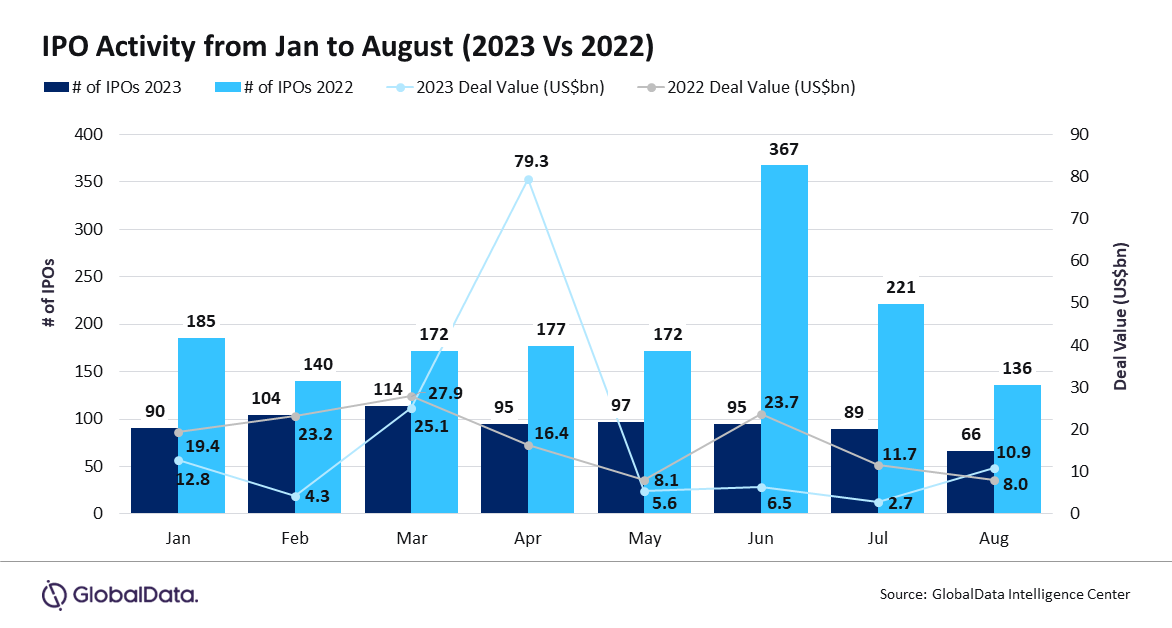

An analysis of GlobalData’s Deals Database reveals that there were 750 IPO listings registered with an aggregate deal value of $147.2 billion in the first eight months of 2023 on the stock exchanges worldwide. This was a sharp 52.2% decline compared to the 1,570 listings with a deal value of $138.6 billion during the same period in 2022.

Murthy Grandhi, Company Profiles Analyst at GlobalData, comments: “One of the primary reasons behind this significant drop can be attributed to a deceleration in worldwide economic growth, stringent monetary measures, and escalating geopolitical conflicts. The US SPAC market faced persistent challenges, as negotiations grew more intricate. Moreover, there remains a substantial number of SPACs that have not yet revealed plans or completed the de-SPAC process, putting them at the risk of liquidation as their expiration deadlines approach in the upcoming months.”

The Asia-Pacific region recorded the largest number of transactions, totaling 491, amounting to $44.4 billion in value. Following closely, North America had 139 deals valued at $17 billion.

At country level, India secured the top position with 152 transactions worth $3.8 billion, primarily due to a higher number of SME IPOs. The US came in second with 99 deals of $16 billion while China ranked third with 88 transactions worth $32.3 billion.

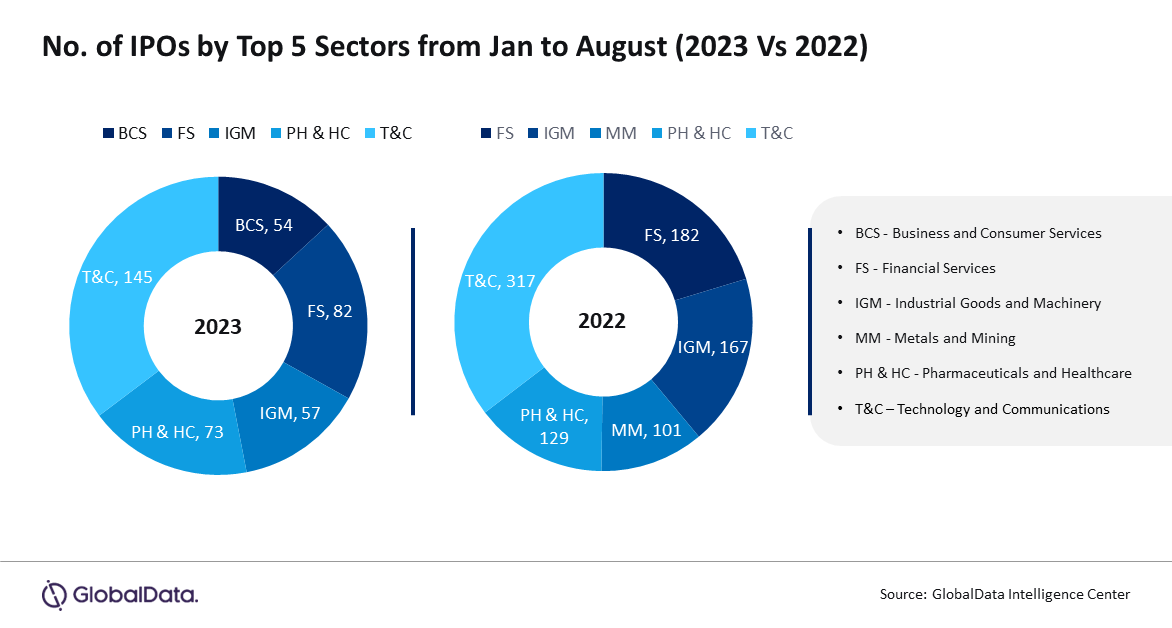

The sectors leading the way in IPO activity were technology and communications, registering 145 transactions with a total value of $75.9 billion. Following closely were financial services, with 82 deals ($6.05 billion), pharmaceuticals and healthcare with 73 transactions ($3.9 billion), and industrial goods and machinery with 57 deals ($2.9 billion).

Few prominent IPOs include Astor Enerji AS and Kenvue Inc with deal values of $4.8 billion and $4.3 billion, respectively.

Grandhi concludes: “The global IPO activity is expected to rebound in late 2023 or early 2024 as economic conditions and market sentiment gradually improve, coinciding with the final stages of the tight monetary policy.”