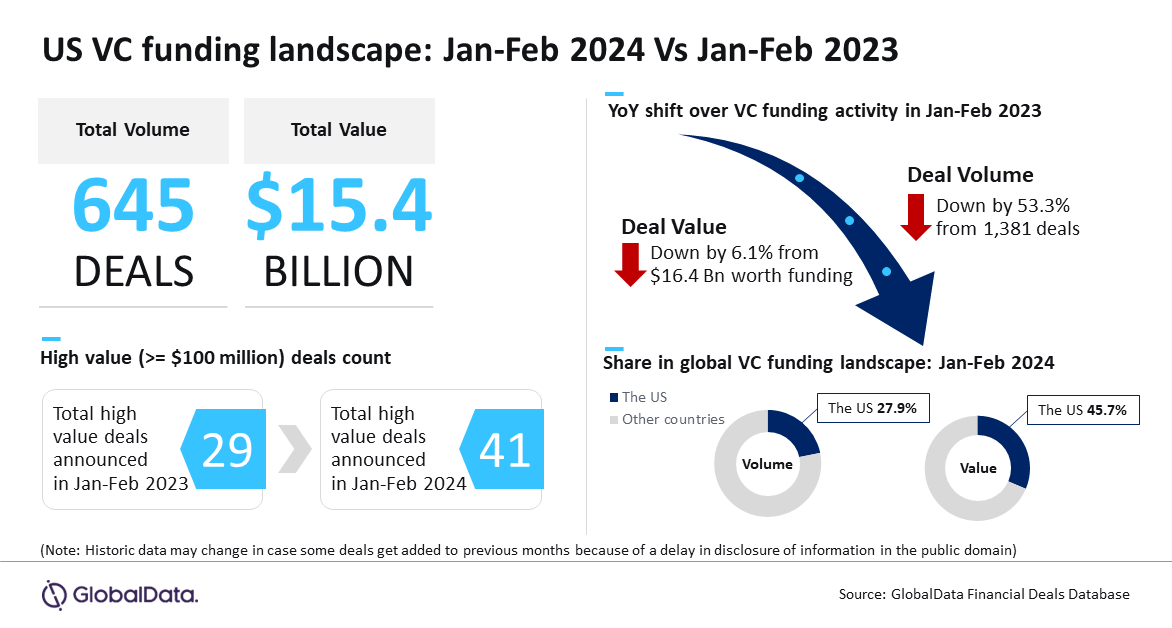

A total of 645 venture capital (VC) deals of worth $15.4 billion were announced in the US during first two months of 2024. This represents a significant year-on-year (YoY) decrease of 53.3% in deal volume, while the YoY decline in disclosed funding value was recorded at 6.1%, according to GlobalData.

An analysis of GlobalData’s Deals Database reveals that a total of 1,381 VC deals were announced during January-February 2023 with the disclosed funding value of these deals pegged at $16.4 billion.

Aurojyoti Bose, Lead Analyst at GlobalData, comments: “Amidst this decline we can see some bright spots as well.

Despite a 53.3% decrease in total deal volume for January-February 2024, the impact on total deal value appears minimal, with only a 6.1% decline.

Additionally, after experiencing consecutive months of decline, the US saw a notable improvement in VC funding deal volume and value, with increases of 12.2% and 80.3%, respectively, in February 2024 compared to January 2024.

It will be intriguing to observe if this momentum persists in the upcoming months.”

The relatively better performance in terms of value compared to volume is indicative of the attractiveness of the US market for VC firms. The US still continues to be the top market for VC funding activity globally in terms of both deal volume and value.

The US accounted for 27.9% of the total number of VC deals announced globally during January-February 2024 while its share in terms of disclosed funding value stood at 45.7%.

The US also managed at attract some big-ticket investments during February 2024. Some of the notable VC funding deals announced in the US during the month include $675 million worth of funding raised by Figure, $320 million funding raised by Lambda, $300 million worth funding raised by Rain Technologies, $231.5 million secured by NinjaOne and $102 million raised by Bugcrowd, among others.

Of these startups, Figure, Lambda, NinjaOne and Bugcrowd joined the unicorn club with the funding raised during February 2024.

Bose concludes: “These substantial investments underscore the enduring faith in the US startup ecosystem. Looking forward, it is imperative to monitor if the favorable momentum witnessed in February can endure in the subsequent months. The ever-changing landscape of VC funding, intertwined with global economic shifts, will influence the course of the US venture capital market and its effects on the wider startup ecosystem. Despite hurdles and fluctuations, the US VC market’s resilience and dynamism persist, solidifying its role as a pivotal catalyst for innovation and entrepreneurship worldwide.”