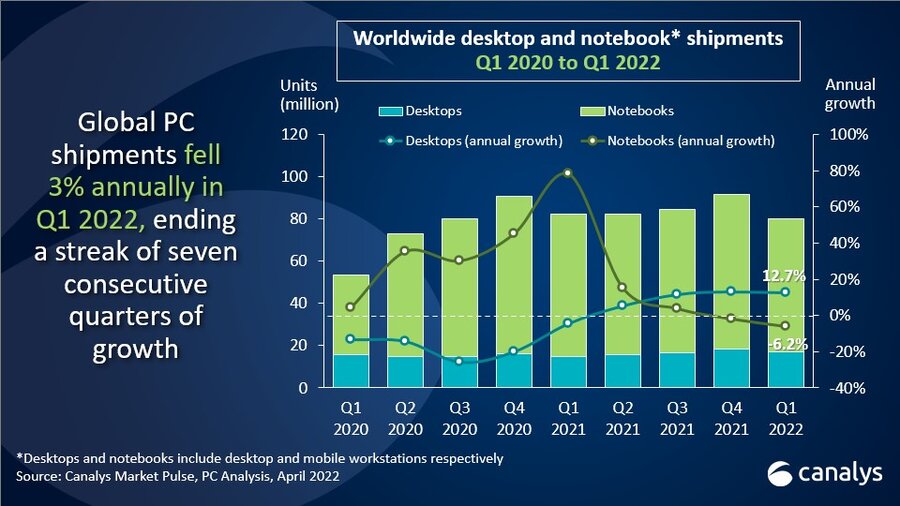

The PC market had a healthy start to 2022 as overall revenue grew by more than 15%, despite the first year-on-year shipment decline since Q1 2020.

The latest Canalys data shows that worldwide shipments of desktops and notebooks fell 3% annually to 80.1 million units against a backdrop of major geopolitical turmoil and softening consumer demand. Revenue, however, hit US$70 billion as prices continued to rise in a supply-starved market and consumers’ appetite for costlier PCs kept increasing.

Notebook shipments shrank 6% year on year to reach 63.2 million units, while desktop numbers grew 13% to reach 16.8 million units.

While shipments have been hindered by external shocks, the revenue outlook and confidence in the long-term opportunity remain high due to the strong fundamentals around PC ownership and use.

“Vendors and their shareholders have reason to cheer, as the PC industry’s revenue growth streak continued,” said Canalys Principal Analyst Rushabh Doshi. “People are using their PCs more often, for longer and for a greater range of tasks than ever before. The last two years have greatly expanded the installed base, with over 150 million notebooks and desktops added between 2019 and 2021. Even if customers are forced to delay purchases due to rising prices in the short term, a large wave of device refresh is inevitable, especially given that more than 50% of active devices are more than four years old. Meanwhile, commercial demand will remain strong this year even as consumer and education purchasing falters. The resumption of workplace activity at close to pre-pandemic levels coupled with hybrid and remote workers needing higher-specified PCs to maximize productivity means business IT expenditure will remain elevated in 2022.”

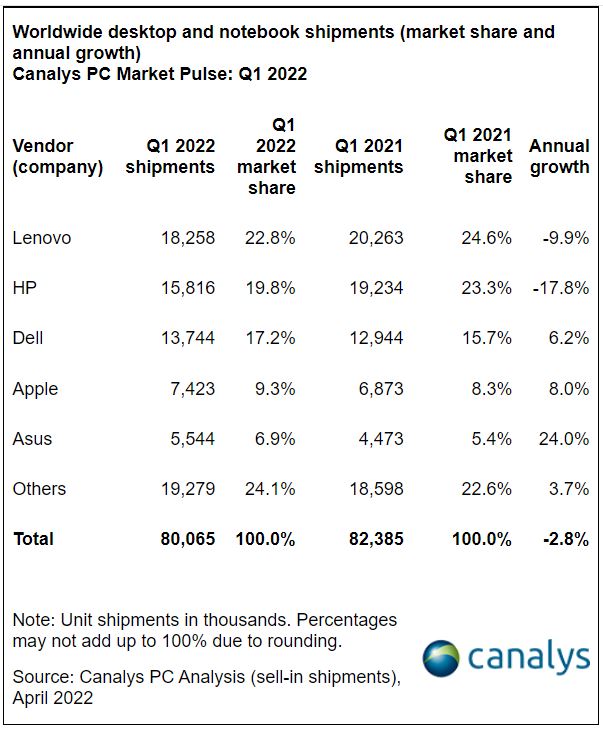

Lenovo remained the top vendor in the PC market in Q1 2022 with shipments of 18.2 million units, for an annual decline of 10%. HP held on to second place but suffered the largest decline of the top five vendors, its shipments falling 18% year on year to 15.8 million units. Third-placed Dell posted healthy growth of 6%, with its shipments reaching 13.7 million units on the back of its strong commercial focus. Apple and Asus also enjoyed growth, increasing shipments by 8% and 24% and taking the fourth and fifth positions respectively. This marks the first quarter in which Asus has secured a spot in the top five vendor rankings since Q3 2017.

“The first quarter of 2022 brought a fresh wave of headwinds to the PC market,” said Ishan Dutt, Senior Analyst at Canalys.

“Seismic global events have had a negative impact on both the demand and supply side, hitting the industry at a time when consumer and education purchases have both naturally slowed after the highs of last year. The war in Ukraine has exacerbated the inflationary environment in major markets by driving up the price of commodities, ranging from oil and gas to metals to foodstuffs. In parallel, COVID-related lockdowns in key Chinese cities such as Shenzhen and Shanghai have created new bottlenecks in manufacturing and distribution, just as vendors and the channel were beginning to find their feet. With no clear timeline on when these issues will be resolved, and the possibility of other black swan events, the industry must be prepared to tackle a new set of challenges and respond with the same resilience it has showed over the last two years.” said Dutt.